There are many changes in the financial sector since the advent of blockchain technology. Several companies, especially startups, have come up with innovative ways to help accomplish the Sustainable Development Goals set by the United Nations. Additionally, blockchain is forecasted as the next transformative technology by the World Economic Forum, European Parliament, IBM and Barclays to name a few.

Since most applications of blockchain technology aim to provide transparency and indisputable records of transactions, it also has a great potential to eradicate corruption. With digital ledgers providing a secure channel for making and recording transactions, anything requiring verifiable and auditable transactions becomes automated. Instead of keeping ledgers in a central place, blockchains get shared across networks encompassing as many users as are registered. Their ledgers keep growing as it records each transaction.

B-corps, often known as social enterprises, are organizations applying commercial strategies to bring about maximum improvements in human and environmental well-being. Such organizations develop programs focused on social impact alongside profit making for the shareholders. Social enterprises could be structured as for-profit or non-profit and may take different forms depending on the host country laws. They are different from other organizations since their social mission is more important to them than profit making.

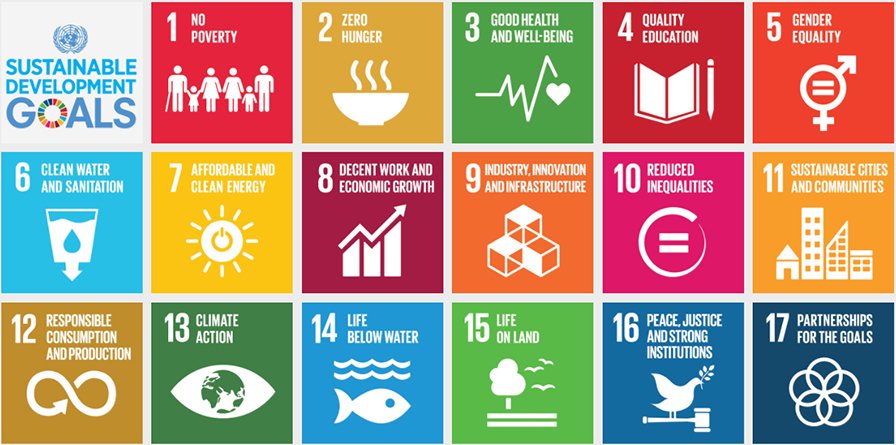

During the 2015 SDG summit, the 193 members of the United Nations passed a resolution to implement the 15-year plan of achieving the 17 Sustainable Development Goals by 2030. These goals are a revision of the Millennial Development Goals chartered in the year 2000. These goals are:

Blockchain Startups Implementing the SDGs

#1 E-Residency

[embedyt] https://www.youtube.com/watch?v=9gnXZBHq0Ns[/embedyt]

e-Residency is a project of the government of Estonia. Estonia is on a mission to build the most advanced digital society in the world.

In 2014, Estonia became the first nation to open its digital borders to everyone around the world. This allows anyone to become an Estonian e-Resident. This is a commercial residency and has nothing to do with citizenship in the traditional sense. This e-ID enables one to conduct commercial activities in both the public and private sectors. It is more of an international passport in the virtual world. The national ID card, for the first time, includes more than the traditional identification features. It provides access to all the government e-services as well. This includes services provided to Estonian citizens such as digital signatures, bank account information, travel identification, e-voting, e-prescription, medical records, and tax submissions.

Estonia is the first nation to publicly work with blockchain technology at the national level. This could simplify bureaucracy, secure personal data, and breed transparency. For instance, e-resident could see who accessed their medical records or other data.

#2 Humaniq

[embedyt] https://www.youtube.com/watch?v=PY_efnojVcE[/embedyt]

The main aim of Humaniq is to build banking solutions for the developing world. So many people around the world go without bank accounts and yet own mobile phones. With biometric identification built into the app, Humaniq intends to provide secure transactions to these individuals.

Humaniq is essentially a mobile wallet you can use to store and transact stores of value. It is designed to work with universally recognizable symbols instead of words and will work with the cheapest Android smartphones. It will implement face and voice recognition to verify account holders’ identity. This process of bio-identification will enable people without official identification to access crypto financial services, and ultimately the world economy.

Transactions conducted on this system will be fully transparent, preventing any use for illegal purposes. Local currencies will be available to use in the app.

#3 BitPesa

[embedyt] https://www.youtube.com/watch?v=Vc5DPUBZhEE[/embedyt]

Launched in 2013 and headquartered in Nairobi, Kenya, BitPesa is a digital currency exchange with operations in several locations including London, Dakar, and Lagos. In 2014, it launched a beta site that allows users to send money to any mobile money wallet within Kenya, and by 2015, it began offering payment to and from seven mobile money wallets and more than 60 banks in Kenya, Nigeria, and Tanzania.

In 2017, BitPesa closed a $2.5-million funding round, making it the largest payment company in Europe, UK, and Africa offering real-time settlements and at wholesale Forex rates.

The main aim of BitPesa is to help diasporas transfer money to Africa quickly and cheaply. They accept digital currencies and offer users fiat money in exchange. It allows users to bypass the mammoth wire-transfer companies like MoneyGram and Western Union. This reduces the fees by two-thirds, resulting in savings of about $74-million each year. Since the average remittance fee to Africa is about 11.8% by other companies, which is higher than the global average of 8.9%, BitPesa will play a major role in lowering the global cost.

#4 Provenance

[embedyt] https://www.youtube.com/watch?v=QWkAx7Qw5v8[/embedyt]

Provenance is using blockchain technology to make secure tracing of certifications possible. It enables the trace of physical products through the supply chain using certifications and other salient information.

Provenance enables the use of digital product passports to prove authenticity and origin, creating an auditable record of the journey a physical product has taken. This startup aims to prevent the sale of fake goods and reduce the cost of certification—certification that often causes businesses to double spend.

With an increase in the need for transparency, Provenance will help most people know more about the products used every day. As the products travel all the way from the manufacturer, distributor, retailers, transporters, sales and delivery networks, it will be possible to track the goods for authenticity.

Provenance will curtail the instances of slavery, child labour, forgery, environmental damage and unsafe working conditions.

#5 Impak Finance

[embedyt] https://www.youtube.com/watch?v=UwY81ZYYkVo[/embedyt]

Focused on impact investing, Impak Finance intends to create a socially responsible bank in Canada with the aim of investing in social enterprises. Impak will launch a regional retail bank that uses fractional reserve banking to exclusively invest in the impact economy. Their business member ecosystem will use their Impak Coin (MPK) for payment.

They plan to open a chartered bank in 2019. In the meantime, they are working on the technology and necessary resources to make the whole thing work, including:

- New risk assessment methodologies

- An impact investment fund

- A digital social media platform

- A payment gateway

The core audience will be risk managers, impact investors, crypto enthusiasts and social entrepreneurs.

#6 Everex

[embedyt] https://www.youtube.com/watch?v=YnzO20cP1Z4[/embedyt]

This Singapore-based blockchain startup launched in 2016 and focuses on building platforms to conduct cross border transactions with real-time settlements, coupled with blockchain technology for security. It targets the 3.5-million people around the world who are underbanked and unbanked due to the lack of access to modern financial institutions.

Everex has created cryptocash assets using the Ethereum blockchain. With cryptocash, expats, migrants, and international aid organizations can cheaply and efficiently transfer money to any part of the world. Everex intends to put equities, fiat currencies, commodities and nonfinancial assets on the Ethereum blockchain. This will facilitate the capital markets, currency exchange, and peer-to-peer remittances globally.

Since the global remittance industry still suffers from various challenges, Everex aims to improve this by reducing fees, delays, and queues. Those working overseas pay so much in remittance fees to send money to their families back home. With this global remittance option, people will be saving a lot of money annually.

#7 Stellar

[embedyt] https://www.youtube.com/watch?v=EA53r43vGCA[/embedyt]

Stellar is an open-source protocol connecting payment systems, banks, and people to integrate quick, reliable movement of money at almost no cost. With many servers running the Stellar software over the internet, a global value exchange network is created.

Each server on the Stellar network stores a record of all the transactions done over the network in a ledger. Individual servers propose changes to the ledger by proposing transactions. When approved, it moves from one state to another by changing property or spending the account balance. When all the servers have come to an agreement on the transaction through consensus, the transaction is recorded in a span of 2-4 seconds and every server updates the ledger.

Stellar is being implemented by several non-profit organizations in the developing world as their financial infrastructure. A good example is the Praekelt Foundation in Sub-Saharan Africa. The foundation has integrated it into Vumi, the messaging app to help young girls save money in airtime credit.

#8 Alice

[embedyt] https://www.youtube.com/watch?v=TqfiMDHB-kA[/embedyt]

Alice is a tech startup in partnership with the UK-based charity St. Mungo, focused on creating better transparency for charity donations. By leveraging the security and trust of blockchain technology, Alice aims to increase public trust in charities.

A 2016 study by the British government stated how public trust in charities was decreasing, hence this move by St. Mungo and Alice. Since blockchain when established correctly is immutable and offers transparency, Alice seeks to restore trust in charitable organizations.

Alice uses Ethereum smart contracts to create a hyper-transparent platform for donations. Similar to an escrow service, its smart contracts hold donations until agreed outcomes are achieved by charities. Then the smart-contacts release the funds. This provides traceable accountability validated through secure systems. At the time of writing, Alice operates by freezing a donation until the charity is able to prove it has achieved the goal the donation was meant for.

#9 Change Bank

[embedyt] https://www.youtube.com/watch?v=fHyzf-rQPdE[/embedyt]

Change Bank is designed to allow users to spend their crypto currencies globally with a premium Mastercard. Users also earn rewards when they pay with Change Coins. Change Bank aims to decentralize the banking marketplace to allow people access to plenty of investment opportunities and financial services. Customers can sign up with Change anywhere globally and use them everywhere without physical restrictions, creating a truly global banking experience for users.

Change Bank is using an open API with a vast network of FinTech companies all over the world working to outperform banks. They use the most current blockchain technology, meaning the security and privacy is consistently maximized. Security breaches are rare, so hackers are less likely to access your wallet or personally identifiable information. The system is sound, and is regularly updated for security and usability as they continue to incorporate emerging technological features.

#10 ID2020

[embedyt] https://www.youtube.com/watch?v=c5P0J-eXUek[/embedyt]

ID2020 works towards solving the problem of identity exclusion to over a billion of people worldwide through a public-private partnership. It focuses on protecting individuals through the four principals of identity:

- Principal 1: Personal identity unique to you

- Principal 2: Persistent identity from life to death

- Principal 3: Private identity only key-holder can use

- Principal 4: Portable identity accessible worldwide

This goal aligns with the United Nations SDG 16, aiming to promote an inclusive society and accountability at all levels. It aims to promote legal identities, including birth registration. Companies like Cisco Systems, PriceWaterhouseCoopers, Accenture, and Microsoft are all partners in this venture.

John Edge started this project due to the need for a self-sovereign identity, a concept that says people and businesses should be able to store their own identity data and provide it efficiently without needing to validate it and without relying on a central repository of identity data.

#11 Ambrosus

[embedyt] https://www.youtube.com/watch?v=bc8SDl3NfBw[/embedyt]

Ambrosus is working on introducing blockchain technology to the food supply industry. It describes itself as the world’s first food ecosystem you can trust. It utilizes blockchain technology, high-tech sensors, and smart contracts to bring about an immutable record of the transactions taking place in the food industry.

They ultimately aim to assure food quality. Instead of leaving this trust with manufacturers, you can personally check the origin of the food you consume. This will provide a transparent trace of the journey your food has taken to your plate.

Founded in 2016, this Swiss-based startup has the support of the United Nations. It uses Parity technology in creating a verifiable community-driven system to assure the origin and safety of the food using the Ethereum blockchain. With smart contracts, this system allows for a smooth and automatic governance of the food supply chain. It is connected to quality assurance sensors that can record the entire history from farm to fork.

The uses of blockchain technology are expanding into areas not previously thought possible. The major drivers of this technology are the startups since they can build the organization from the ground up on a framework designed to work with blockchain technology, and in some cases, cryptocurrencies.

Opinions expressed here are opinions of the Author. Influencive does not endorse or review brands mentioned; does not and cannot investigate relationships with brands, products, and people mentioned and is up to the Author to disclose. Accounts and articles may be professional fee-based.