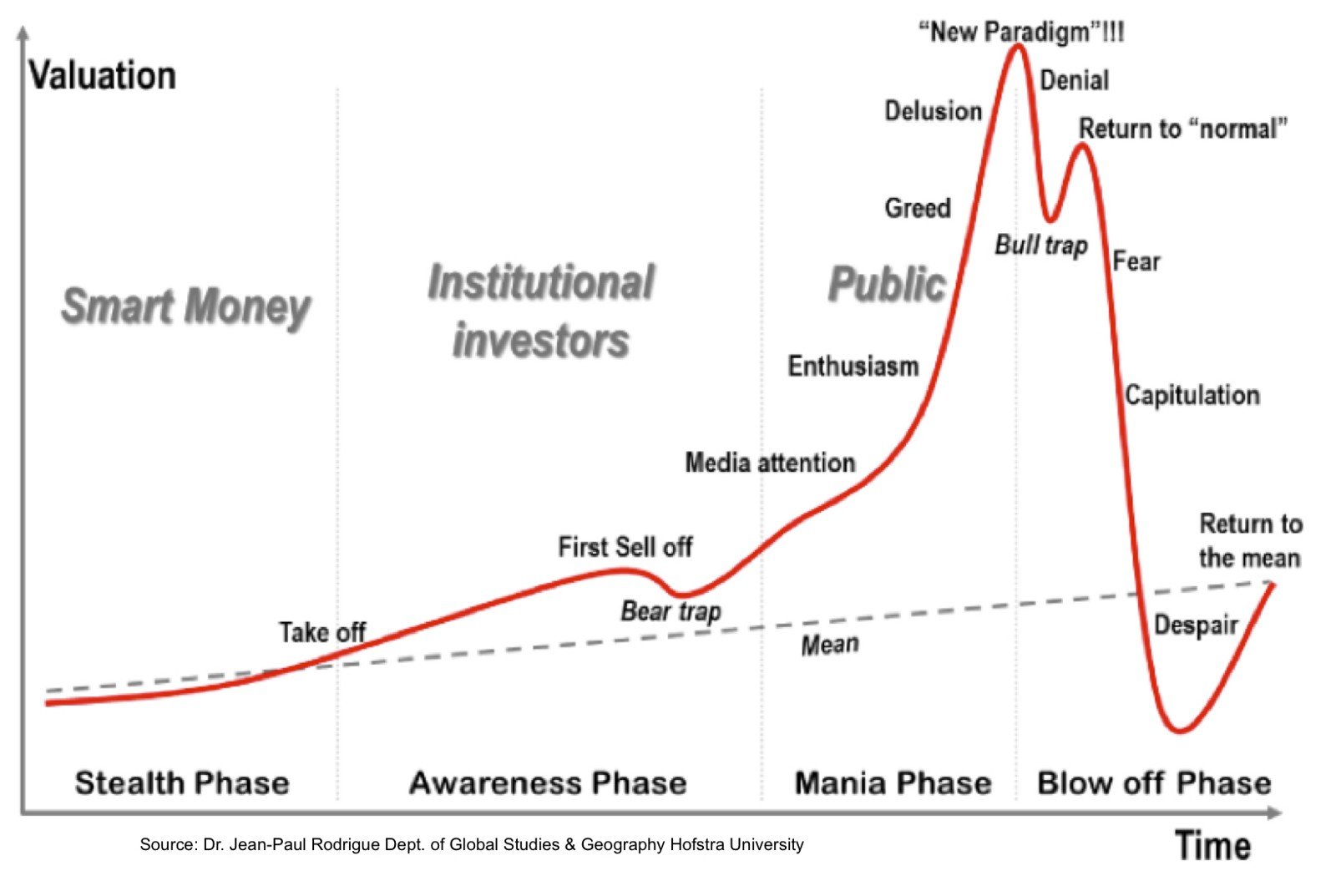

For many, the past eight months have been painful, and I’ll admit I’ve definitely shared some of that pain on the way down. What I didn’t do was sit around once the bear market began. I was on a quest to learn as much as possible, whether it was in technical analysis (TA) or simply reading more books or articles on Bitcoin, finance, monetary policy, etc. Now, nobody wanted to call top back in January, February, and even really until May when the “Consensus Pump” never happened. It is pretty apparent we are at or near capitulation now. The signs are everywhere: more and more talk shows discussing how Bitcoin is dead, even though they couldn’t tell me what the difference between PoW (Proof of Work) and PoS (Proof of Stake).

Now we must ask, why are people capitulating?

Overexposure, lack of understanding of crypto, no historical knowledge on price appreciation, poor risk management, and the list goes on.

All markets are driven by Fear, Greed, & Hope.

When you look at a chart of a stock or cryptocurrency, all it is showing you is emotion. People use candlesticks to help see these emotions. Some would call it the language of the market.

I’m by no means a Crypto OG – people who have been around the space since 2014 or earlier.

My Story and Lessons I Had to Learn Fast

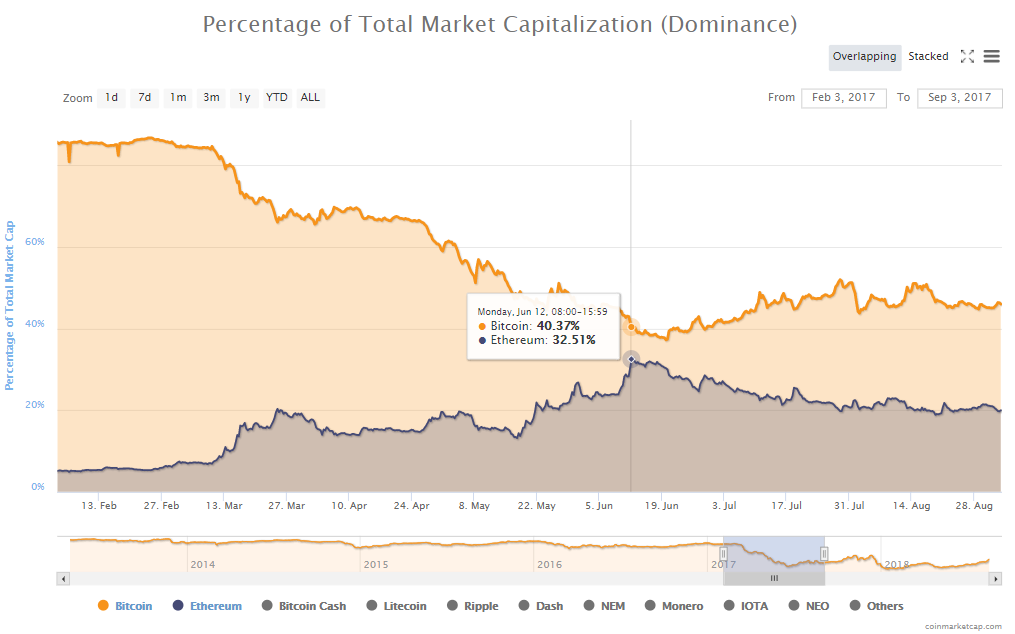

I happened to jump down the rabbit hole in early May 2017, when the altcoins went bananas and Bitcoin crossed $2,000. I am still kicking myself for not originally looking up Bitcoin back in 2013 when a friend from high school was being evangelical about it, or when my buddies and I were discussing in early 2016 how companies were filling warehouses with miners, or when I saw that Ethereum had moved from $8 to $33 in early 2017 and still didn’t look into it. Nope – I got in, and by the time I was getting sorted out on exchanges, I was practically buying the top on two alts, Ripple and Siacoin. Initially, I didn’t want to buy any Bitcoin, because it was too expensive, but man oh man, those sub-dollar altcoins caught my attention (many of us traders regretted this in hindsight when alts were stagnant in USD and lost value in Bitcoin as it marched from $3,000 to $20,000). I consider myself now more or less a Bitcoin Maximalist, as I see the need for a base layer that is immutable.

The only thought that was running through my head was, “if I buy 5000 of X and it goes to $5, I’ll make $25,000!” This was before I understood supply and market caps well… I have come a long way, to say the least. It was baptism by fire last year. I was learning quickly, I can’t tell you how many shitcoin pumps I had to chase to realize that is not the way to trade (shitcoin is a term for anything that is not Bitcoin). It hurt, but the amount I was investing was small, so it wasn’t detrimental. I remember being at my internship in June 2017 after buying Ripple and Sia, and watching them continue to fall as Ethereum crossed $400. The “flippening” was imminent it appeared. Then everything dumped, hard. Thankfully, with paychecks flowing in despite being paid nil at my internship, I had fresh cash to keep dumping into these discounted alts.

One of my best experiences in crypto came from a blockchain and crypto event I attended back in August 2017 in Los Angeles, Elevator Night – Blockchain & Crypto. It was quite small, with maybe only roughly 150 attendees, so you got to speak to a lot of people. But the best part came from a man who was one of the final speakers, and one of the smartest I had met in crypto. I spoke to him prior to him speaking, and he was quite liquored up at this point – I don’t blame him, it makes it easier to speak in front of people. I knew right away this guy knew what he was talking about.

When he spoke, it was a different tone than all the exuberance most of the other speakers and attendees shared. He spoke about reality. That all altcoins are overvalued and that very few will remain once this deflates. He added on that many of these tokens have flawed code due to the fact that people were literally copying and pasting code from other projects – you can imagine how a flaw can proliferate that way. How was he able to speak about this perspective as many of us were experiencing insane returns on these digital assets? That’s because he witnessed the Genesis Block be mined. He had been mining Bitcoin since 2010, so he had been through the ups and downs. He said something that stuck with me and I will paraphrase it to the best of my memory while he was speaking to a group of us after his panel ended:

“You guys think you are early? This is a seven-year-old market. Early was 2013, 2014, 2015. You have to put this in perspective, there are people who have been in crypto for six years and now you show up, and expect it will just go all swell and keep rising. It won’t.”

One of the most important things he mentioned was “know your origins”, referring to Bitcoin white paper and the genesis block. There is a newspaper headline in the genesis block that reads: Chancellor on Brink of Second Bailout for Banks. After saying that he said:

“Given headline, who would make the genesis block if it was not a crazy cryptographer (Satoshi). Why are groups getting caught – Dark web, Silk Road?”

I still have been trying to figure that out a year later. The theories are endless.

One of the best advice for long-term he gave was to stay away from ERC 20 tokens besides Ethereum. In the short-term up to early January, he was wrong. As we witnessed a face ripping melt up across the whole market with ERC 20 coins like Omisego (OMG) ICOing for $0.25 and peaking at $26 – over 10,000% return for ICO investors in six months. But from January on he has been more correct than all the naive Telegram channels, Facebook groups, and Reddit posts that were still searching for higher highs that never came.

It was this knowledge that I happened to be lucky to randomly pick up because I skipped the last day of my internship to attend the event after messaging the man running the event, Dan Fleyshman two days ahead of the event. He saw I was so eager to go to this, he offered me a free ticket and by Thursday morning I had bought my Friday morning flight to LA for the event that night and the rest was history.

One of the biggest shockers came when I attended the same crypto event, except in May of 2018.

Differences in Events – Before & After the Burst

This event was hosted by the same people, but there were different speakers and more people at this event. One of the biggest things I noticed at the event was the sale of hopium – selling hope to people of higher prices down the line. It irked me because at this point I was much more knowledgeable about crypto and was witnessing speakers attempt to sell a trading plan for a couple thousand dollars (which did not happen at the previous event, which was why I was shocked) to people who knew very little about crypto. It was pretty obvious by this point in May with the $10,000 rejection of Bitcoin just a week before, that we were not going to be seeing any new highs anytime for the near future.

The event barely talked about the importance of Bitcoin and how the current monetary system is unstable. No, they were there to sell hope that coins were going to pump instead of talking about what makes Bitcoin or Ethereum unique and risks involved investing at these highs after a record-breaking year last year. Granted, they did have a few good panelists up there who spoke about the reality of trading and the fact there are no protections in crypto against manipulation. It’s better to give your constituents the cold truth than false realities.

Why Did People Get So Burned?

People got wrecked because they weren’t prepared or had zero knowledge on what they were “investing” in. No preparation to offload or hedge against a decline in Bitcoin and alts. Many were naive, thinking that there was no way this would come down, a “Permanent Plateau” some would say. Unfortunately for many, this time was no different.

Many rushed the gates in October, November, and December as Bitcoin continued to rise, without looking at any of the previous price appreciation. The only reason these people were buying these bags was because, hopefully, someday down the line, they could dump them on the next greater fool. For many, the reality of being the greater fool didn’t kick in until the past few months of a slow bleed in alts and Bitcoin chopping.

Going Forward

There is hope somewhere down the horizon. Think about how hopeless people were who bought Bitcoin at $1,000 back in 2014 and then proceeded to hold all the way down to $185. It was a time when the crypto community was tiny and still relatively unknown, so you could imagine how quiet things got. The ones that stuck it out are likely millionaires today (if they have good money management) and are experts in a growing industry in which they have a huge head start. The crypto industry is still young in comparison to others. So ask yourself, how can I help this digital asset revolution. If you’re a writer like me, share useful factual info on crypto – don’t go write an article about why this a good time to buy the shitcoin you are bag holding or how coin X will go to $100 in a few months (if you are a trader, it’s one thing to put out price predictions with solid reasons behind whether TA or FA.) Price speculation offers nothing, especially when it is done by people who have no understanding of TA. Create websites that help people understand crypto and related topics. Hop on Github and add some commits to a project. The list is endless.

You have been wrecked, but it’s a learning experience. Most equity traders are lucky enough to go through a market cycle every 8-10 years. You just got that, except sped up at about 100x. Take time to study what happened. It was pretty clear the top was in early January as crypto was all the rage and CNBC was showing viewers how to buy Ripple at $2.71, over 10,000% up from its price a year previously in January 2017. You had articles telling you how everyone in crypto was getting rich. It was very obvious.

Take advantage of the downtime and prepare yourself for the future.

Disclaimer: The views expressed in this article are solely the author or analysts and do not represent the opinions of the author on whether to buy, sell, or hold shares of a particular crypto currency, cryptographic asset, stock or other investment vehicle.

Individuals should understand the risks of trading and investing and consider consulting with a professional. Various factors can influence the opinion of the analyst as well as the cited material. Investors should conduct their own research independent of this article before purchasing any assets.

Past performance is no guarantee of future price appreciation.

This is a Contributor Post. Opinions expressed here are opinions of the Contributor. Influencive does not endorse or review brands mentioned; does not and cannot investigate relationships with brands, products, and people mentioned and is up to the Contributor to disclose. Contributors, amongst other accounts and articles may be professional fee-based.