Index investing is a popular term used in stock trading. It’s a passive investment technique that has various similarities with the returns of a broad market index.

In simple terms, passive investment refers to maximizing your returns by minimizing purchases and sales. Veteran investors use this strategy to mimic the performances of different indexes. For example, investors purchase an exchange-traded fund or an index mutual fund that replicates the underlying performance of the respective index benchmark.

But why is this technique so popular among investors? According to empirical research, index investing has the potential to outperform active management in the long run. Picking an index fund can eliminate uncertainties and biases that arise from choosing stocks. But whilst this investing technique is the status quo in the traditional markets, it is still in its early stages when viewed through the crypto lense. It still has a long way to go before making a significant mark in the token economy.

Phuture, a decentralized protocol, aims to bring a new design to token-based passive investing. Its Index Creator Tool allows for the easy creation of new index strategies. Alternatively, you can browse some of the existing indices that have already been created by the community.

Things to know about Phuture protocol

The Phuture protocol provides a smooth, easy, and powerful way to create token indices. It also comes with a few unique features that set the protocol apart from other platforms.

- Smart rebalancing – Smart rebalancing aims to optimise index performance by respecting relationships between assets and defining dynamic rebalancing ranges. It restricts excessive rebalancing that small movements usually trigger and allows price discovery during large price movements.

- Asset optimization – Phuture composes with other DeFi protocols to enable off-platform yield optimization. Once assets held on the protocol reach a specified level, a portion of them are moved off-platform to generate yield. This improves index returns and ensures the productivity of idle assets.

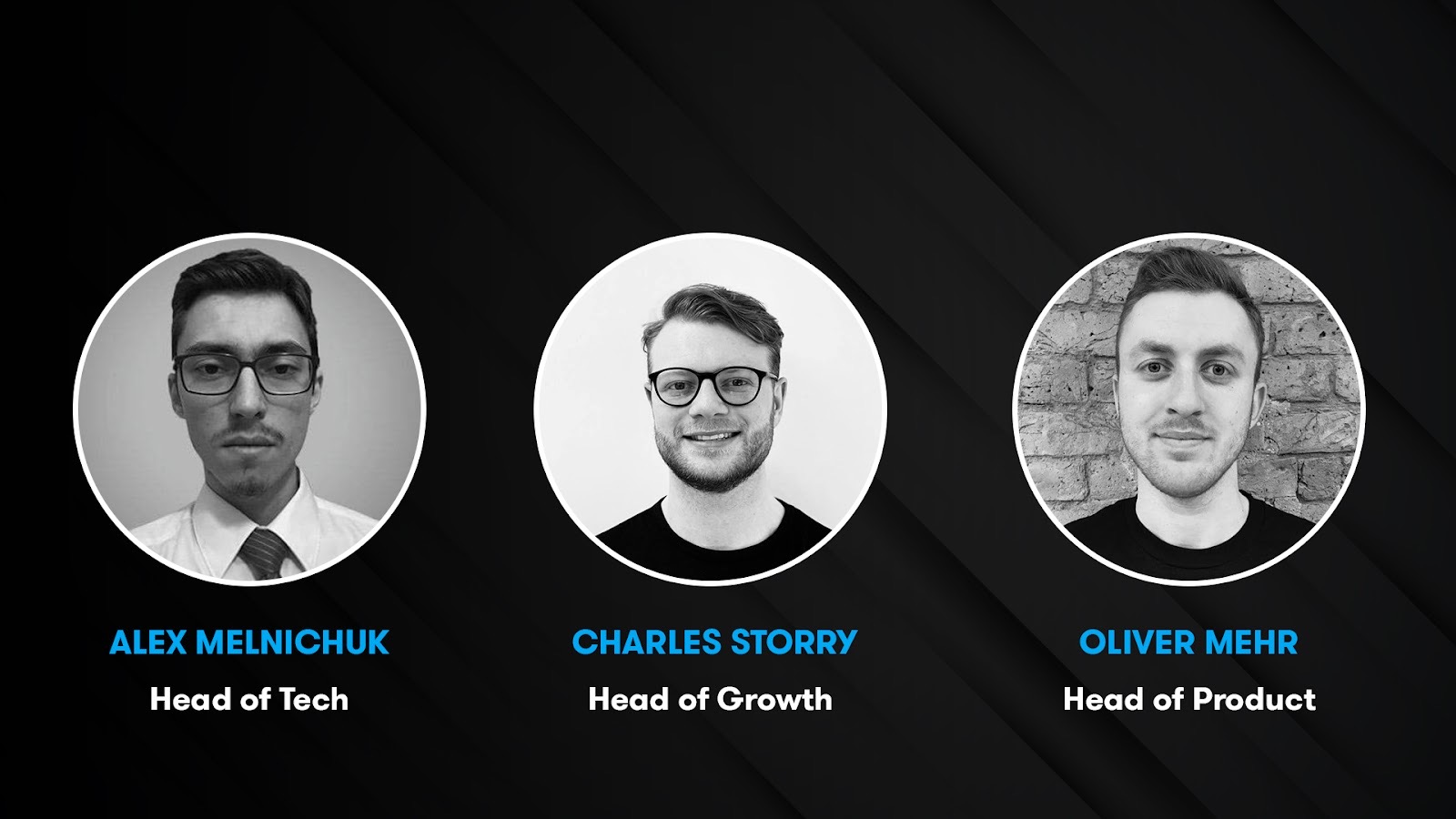

- Flexible index design – The founders of Phuture, Alex Melnichuk, Charles Storry, and Oliver Mehr, unanimously decided to allow users to create their own indices. This decision has influenced how Phuture has been built from its foundations. Users have the freedom to choose from a wide range of assets, weighting options and tracking functionalities. This freedom has been wrapped into the Index Creator Tool, an intuitive step-by-step flow for creating unique index strategies.

Join their journey of disrupting the DeFi sector as well as traditional finance by following them on Twitter

Official website: Phuture.finance

This is a Contributor Post. Opinions expressed here are opinions of the Contributor. Influencive does not endorse or review brands mentioned; does not and cannot investigate relationships with brands, products, and people mentioned and is up to the Contributor to disclose. Contributors, amongst other accounts and articles may be professional fee-based.