Hawkeye Associates wants you to believe they are offering loans with APRs as low as 3.02%. They have begun flooding the market with debt consolidation and credit card relief offers. The problem is that the terms and conditions are at the very least confusing and possibly even suspect. Do you think your approval is coming for 3.02%?

The interest rates are so low that you would have to have near-perfect credit to be approved for one of Hawkeye Associates’ debt consolidation loans.

Crixeo, the personal finance review site, completed a review of Hawkeye Associates, Yellowhammer Associates, Big Apple Associates, Cornhusker Advisors, Badger Advisors, Rockville Advisors, Snowbird Partners, Gulf Street Advisors, Brice Capital, Johnson Funding, Taft Financial, Polo Funding, Jackson Funding, Dune Ventures, Braidwood Capital, Tiffany Funding, Nickel Advisors, Coral Funding, Neon Funding, Polk Partners, Ladder Advisors (also known as Carina Advisors, Corey Advisors, Pennon Partners, Jayhawk Advisors, Clay Advisors, Colony Associates, and Pine Advisors, etc.).

Are you relying on credit card relief to make it through the challenging economic circumstances? If so, you are in danger of building up high debts that will be difficult to pay back. You must cease relying on credit cards immediately and look for better solutions.

The covid-19 outbreak has wrought havoc on the economy, and many people have lost their businesses and jobs in the ensuing mayhem. A lot of people cannot get back to work because of lockdowns.

Even where lockdowns have been lifted, there is an atmosphere of fear as going outside to work increases the risk of infection. It seems that covid-19 is here to stay for at least several months and won’t go away any time soon. Thus, you will need to seek out better ways of sustaining your household rather than relying on credit cards.

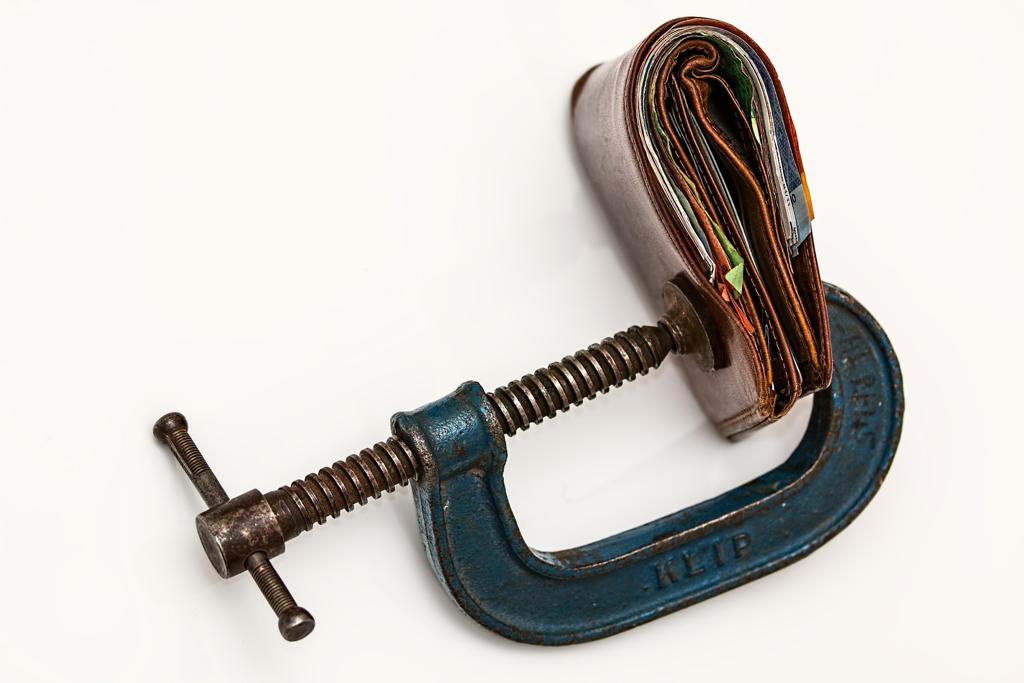

Why Relying on Credit Cards Is Not Good

You might have heard that banks and lenders are being more lenient than usual by offering concessions and favorable terms for those having trouble with paying back their debts. In most cases, these concessions are about extending the payment deadline and reducing the interest rate. You should be warned that card issuers are not waiving the principal amount or the interest incurred prior to requesting concessions.

You might incur a lower interest rate as a result of the concession or your payment due date might be extended but you will have to pay your debts in full. Therefore, relying on credit card refinancing to make it through is never a good idea. Your card companies may soon insist on repayments. If you are unable to pay back, you may have to file for bankruptcy which will stay on your credit report for years.

Instead of relying on credit cards, you must seek other ways out of the imbroglio. First, you must check out what measures your credit card issuers provide by way of relief and concessions for debt-encumbered customers. There is a good chance that your credit card issuers are lowering interest rates for those having difficulties paying back their debts.

Instead of relying on credit cards, you should cease using them and immediately apply for such beneficial terms. By lowering the interest rate, you will save a lot of money that you will otherwise be owing. You may also get other benefits like extended deadlines.

Rather than relying on credit cards or debt consolidation, you should see if you qualify for stimulus checks and other benefits schemes. You should also get in touch with your employer to find out if they are offering any benefits to staff that cannot work. There is no harm in knowing and finding out. You never know what you might uncover. Hence it is better to search for other opportunities instead of relying on credit cards.

In the US, states are issuing orders to lenders and credit card issuers to delay payments. However, just because credit card issuers won’t demand payment now does not mean that they will not ask for it later when they are allowed to do so. Postponement does not mean forgiveness. Hence, relying on credit cards to get through the crisis is imprudent.

Bankruptcy

If your situation is too dire, then you may have to file for bankruptcy. However, this is the most extreme option and the last resort. It would help if you exhausted all other avenues before resorting to a bankruptcy filing.

Although bankruptcy might seem nightmarish in normal circumstances, you may have no other choice under the current circumstances. It would help if you talked to your financial advisor to determine whether or not filing for bankruptcy is better than relying on credit cards. Bankruptcy may be something that you may no longer be able to postpone. After a specific time frame, credit card issuers may come to you and demand payment.

Avoiding Relying on Credit Cards

One crucial fact that you must keep in mind when relying on your credit cards is that so far, various states have ordered lenders and credit card companies to show forbearance. That is, governors have issued orders for credit carriers and lenders to extend payment deadlines. So far, there has not been a single order about debt forgiveness. Considering the nature of governor orders seen till now, it seems unlikely if there will be any pressure on lenders and credit carriers to forgive the debt. Hence, relying on credit cards is unsustainable in the long term since you won’t have any of your debt forgiven.

Thus, whatever debt you have accrued to date by relying on credit cards, all of it must be paid back later. It is better to stop relying on credit cards than to fall into a giant debt trap and watch as the interest grows exponentially.

Instead of relying on credit cards, you should turn to friends and family for financial support. While it might seem undignified to plead for funds from friends and family, it may be much better than piling up credit card debts. You will, of course, have to explain to your would-be benefactor that you will be able to pay once the economic situation improves and you get your job back.

You will have to convey that the only reason you are borrowing is that you have lost your income stream to the current COVID-19 pandemic. As the situation gets better and jobs are created, you will do your best to find one and make loan repayment your priority.

To further reduce relying on revolving debt, you will have to take measures to bring down your expenses. Given how dire the fiscal scenario is for you, you must relinquish all entertainment expenses. As far as possible, you must cook your food instead of eating outside and look for cheaper alternatives. You may also have to take strict measures like canceling certain subscriptions in favor of cost-effective options.

It might seem harsh for you now, but whatever steps you take to cut down on credit card use will benefit you soon as you will have a smaller balance to pay back.

This is a Contributor Post. Opinions expressed here are opinions of the Contributor. Influencive does not endorse or review brands mentioned; does not and cannot investigate relationships with brands, products, and people mentioned and is up to the Contributor to disclose. Contributors, amongst other accounts and articles may be professional fee-based.