On Wednesday, a flash announcement on the website of the U.S. Justice Department regarding a forthcoming crypto-related enforcement action triggered a significant drop in prices.

The ‘announcement of the announcement’ from the DOJ had traders wondering what pain lay in wait, with speculation running rampant in the 1 hour time frame between the bulletin and the press conference. The resulting panic selling led to Bitcoin and Ethereum falling below recently established support levels gained during the previous week’s bullish activity.

the doj reveal their target

It emerged soon after that the DOJ would be joined by the FBI, the US Treasury, and the Office of Foreign Assets Control (OFAC), which only ramped up the fear and took prices on a further dip. Based on this, theories as to what the announcement’s subject matter ranged from a ban on Tether (USDT), the first steps towards a Central Bank Digital Currency, with some even worrying that Binance was somehow involved in the mix negatively.

🚨 URGENT WARNING 🚨

THE DEPARTMENT OF JUSTICE, FBI, US ATTORNEY, NYAG AND THE DEPARTMENT OF THE TREASURY ARE ANNOUNCING A MAJOR CRYPTO CRIMINAL ENFORCEMENT TODAY.

GET ALL CASH & CRYPTO OFF ALL EXCHANGES IMMEDIATELY. DO NOT DELAY. THIS IS NOT A DRILL. WARN FRIENDS AND FAMILY.

— Parrot Capital 🦜 (@ParrotCapital) January 18, 2023

However, the veil of impending doom surrounding Crypto Twitter and the markets lifted once the conference began, as it was revealed the target of the US authorities was none of the aforementioned but was in fact a little-known crypto exchange based in Hong Kong – Bitzlato.

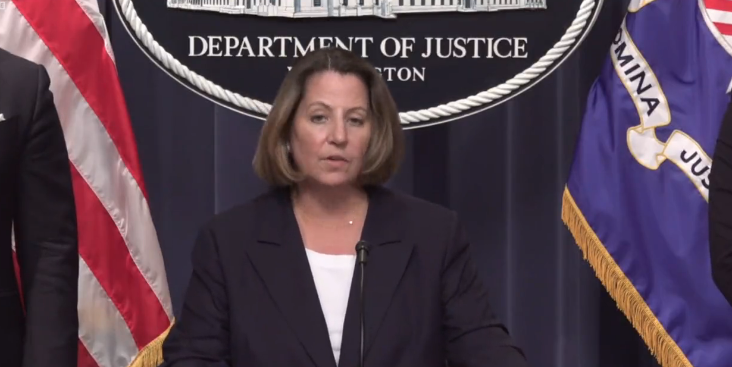

To summarize, Bitzlato has officially been shut down and its founder, Anatoly Legkodymov, has been apprehended by U.S. authorities on charges of money laundering a whopping $700 million over the past several years. Deputy Attorney General Lisa Monaco stated at the press conference:

“Today, the DOJ dealt a significant blow to the cryptocrime ecosystem. Today’s actions send the clear message: whether you break our laws from China or Europe – or abuse our financial system from a tropical island – you can expect to answer for your crimes in a U.S courtroom.”

bitzlat-who?

Without detracting from the very serious nature of the alleged criminal activity in this case – from a purely crypto trader/investor perspective, the news was a welcome relief that another Black Swan event was not on the cards. The market reflected this by rebounding slightly soon after.

According to @jconorgrogan, a Director at Coinbase, Bitzlato tagged wallets had a total of only $6 million at their peak in 2021. Furthermore, crypto exchange ranking sites did not have Bitzlato featured in the top 50 (for trading volume), and the centralized exchange’s (CEX) Twitter account only had 1250 followers at the time the news broke.

To give context, the crypto exchange ranked 200th on CoinMarketCap, YoBit, boasts 170.9K followers – and they haven’t tweeted since March 2022.

A sign of things to come?

Despite this, not everyone was relaxed about the news. @scienceXBT posted a thread exploring some of the reasons why such an unknown entity was made an example of in such a grandiose manner, with them stating that the intention could be setting a precedent to enforce more transparency on exchange users with KYC regulation.

The U.S. Department of Justice (#doj) made an announcement on #Bitzlato: they have charged the #crypto exchange and arrested its founder.

I see people mocking the news, because this platform was not widely known

This is NOT funny and here's why you should care

👇🧵1/8 pic.twitter.com/QytT2FEgal

— Science&SELFHOSTED (@scienceXBT) January 18, 2023

“not your keys, not your coins”

Although the fall out from Bitzlato going under has affected a very small number of people, one thing is for certain, “not your keys, not your coins” is more than just a catchy gimmick.

The use of self-custody wallets protects against instances such as this, and certainly against the FTX disaster which befell us back in November, where users lost billions in assets held in custody by the firm. Thankfully, CEX giants, Coinbase and Binance, appear to be in good health and run well by seasoned professionals of the industry.

If you have yet to begin the research into self-custody of your crypto assets, you can start here via this introduction.

Opinions expressed here are opinions of the Author. Influencive does not endorse or review brands mentioned; does not and cannot investigate relationships with brands, products, and people mentioned and is up to the Author to disclose. Accounts and articles may be professional fee-based.