Like many who have been in crytpo long enough, I was starting to get worried about the irrational buying around Thanksgiving and the holidays. It was getting out of hand, and the mainstream media (I’m looking at you CNBC) wasn’t helping as they kept pumping up Bitcoin. Many times I mentioned to friends and family that we’ve been due for a 50% retrace of the cryptocurrency market cap. We haven’t seen anything close to it since September when the market cap went from an all time high (ATH) around $179 billion down to around $97 billion per Coin Market Cap data.

What bothers me is CNBC showing people how to buy Ripple (XRP) and telling them to buy it at $2.50-$3.30. Anyone who understands markets knew that this was completely ludicrous. XRP went from around $0.23 at the start of December to $3.75 (over 1600% gain) by early January per Coin Market Cap data. It was at the top of it’s market cycle, and CNBC lured a bunch of people who trust them as a credible news source. This is why I always preach to people to do your own research (DYOR). If you had listened to CNBC, they were telling you to buy $19,000 Bitcoin, $3 XRP, and Tether (USDT) at $1.06 (Yes, they were telling people to buy Tether).

The title to the Tether article read: “Just one major cryptocurrency is gaining amid a market-wide sell-off”

Oh, really? It’s like they don’t do any research or have editors there. It’s USDT; it’s pegged to the U.S. Dollar so it never moves more than a few cents away from $1. And during any type of downturn, Tether generally bumps up in value as investors/traders try to find a safe haven.

Let this be a lesson, CNBC does not have you, the viewer, in their best interest. Does it mean they’re doing it intentionally? Most likely not, but it shows that they don’t have a good understanding of the cryptocurrency markets.

The Bloodbath

It finally came with enough FUD (Fear, Uncertainty, Doubt) thrown at cryptocurrency. It caused many buyers to sell off as they watched their handsome December profits dwindle. With South Korea putting out a proposal to ban cryptocurrency, it gave the market a nice shock. On top of that, Coin Market Cap excluded volume and prices for Korean Wan (KRW) pairs in many high cap coins like Ethereum and Ripple days before the South Korean proposal, making them look on Coin Market Cap as if they shed over 20% of their value instantly. This caused the market to begin it’s initial bleed on Monday, January 8th.

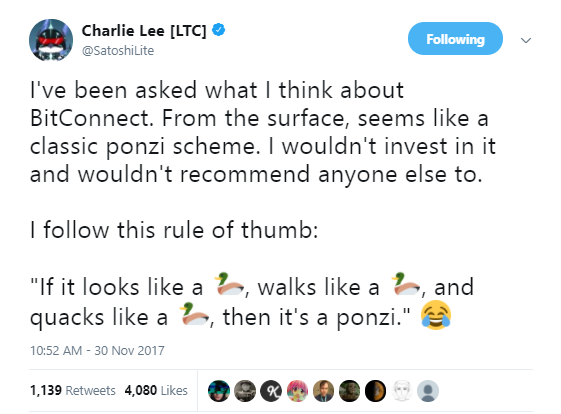

Another thing to note, the Ponzi scheme, Bitconnect finally came crashing down like a house of cards. Many in the community knew this was bound to happen, and I always say avoid any type of MLM (Multi-Level-Marketing) scheme or similar programs. It was clear Bitconnect was done if you looked at the charts on Coin Market Cap in December. It was losing Bitcoin value at an astonishing rate.

Bitconnect’s Reddit channel became a graveyard with posts like, “This can’t be. I lost everything. EVERYTHING” or “800-273-8255 is the Suicide Hotline. Money isn’t everything. Your life still matters after all of this.” The Reddit channel has now been locked up by moderators with no affiliation to Bitconnect since it was getting out of hand.

For those new to cryptocurrency, let this be your lesson here, avoid HYIPs (High Yield Investment Plan) and affiliate marketing schemes as they never end well. There are more of these HYIPs out there so don’t let them lure you in with the hope of daily profits. They are all scams and will eventually collapse.

For those new to cryptocurrency, let this be your lesson here, avoid HYIPs (High Yield Investment Plan) and affiliate marketing schemes as they never end well. There are more of these HYIPs out there so don’t let them lure you in with the hope of daily profits. They are all scams and will eventually collapse.

This tweet from Charlie Lee, founder of Litecoin, sums it up.

Market Cap Chopped in Half

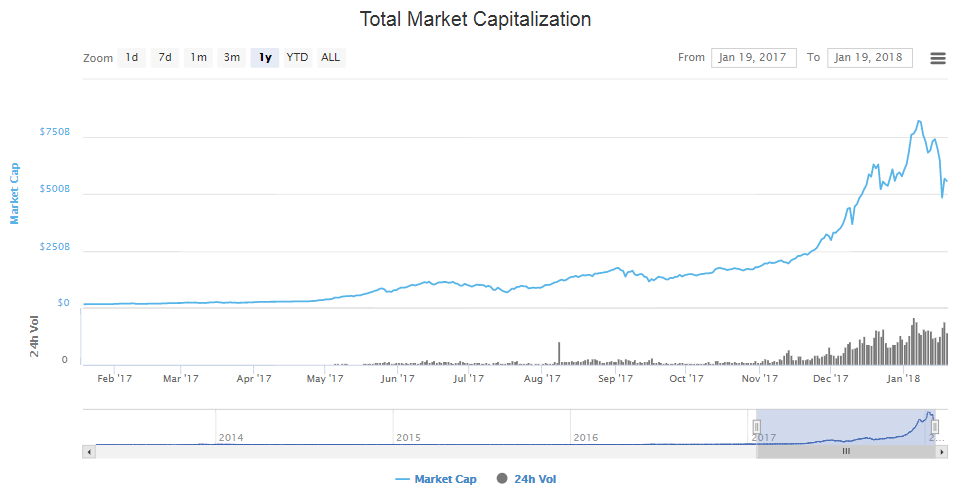

The cryptocurrency market cap peaked at $834 billion on January 7th and hit a low of $414 billion on January 17th. The market has rebounded back up to around $619 billion (as of writing) per Coin Market Cap data (this very well could be a bull trap; if that’s the case, HODL). Never would I have imagined six months ago in July that the $60 billion cap low we hit would be at $800 billion at the start of the new year.

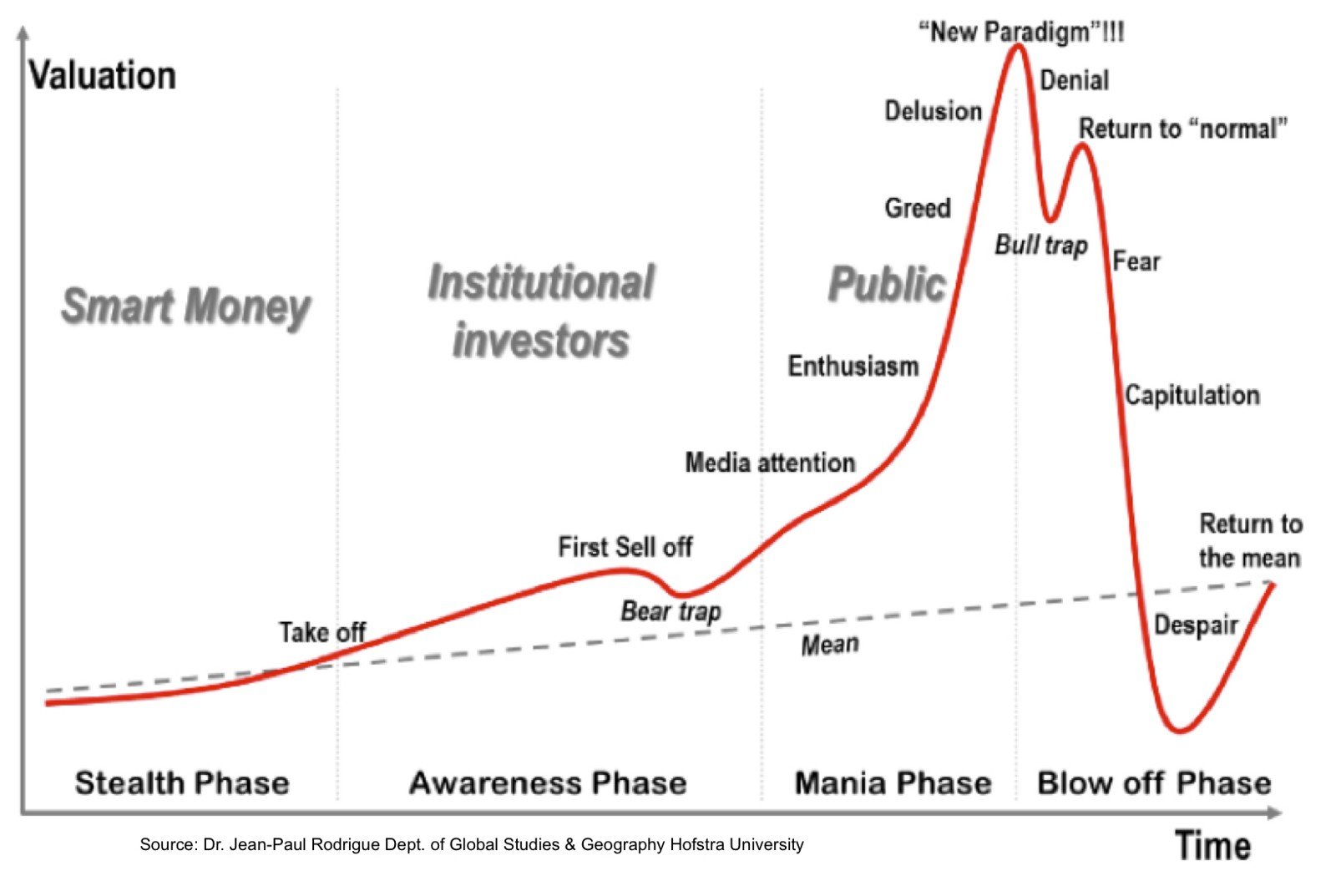

The market was due for this. The total cryptocurrency market cap was $182 billion on November 1st… it grew nearly 450% in the span of two months. This correction was healthy, but unfortunately many people were caught buying in December and their positions were not strong. So once the market began to shed, their positions went from being green to red really fast. Most altcoins retraced anywhere from 40-70%, leading many people to panic sell fearing the worst. The bubble had popped.

The current rebound was a refresher for many, as anyone trying to buy the dip was possibly catching a falling knife. The dip down to $414 billion was at the same levels of the dip we saw on December 22nd that went to $422 billion; there is clear support around the $420 billion level. Looking below both corrections in June-July and September were scary and many were thinking it was the end. There is still a lot of room for this market to grow.

What we just experienced is summed up very well by the chart below. If you want to learn how get good positions, then this chart can guide you.

Achieving Large Returns

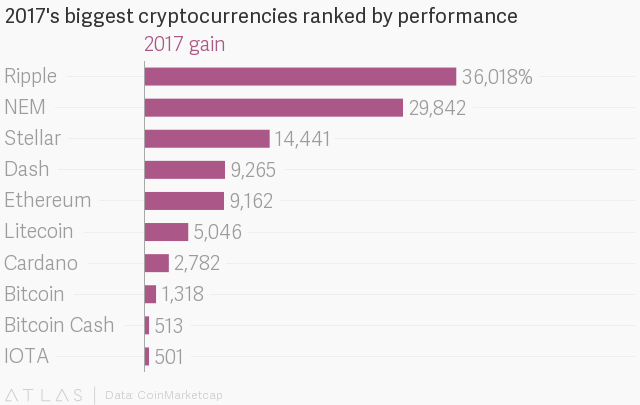

If you don’t take away anything from this article, take away this: the people who hold during these downturns are the ones who make money. Very few people have the emotional discipline (including myself) and skill to execute good entry points and good exit points on trades. Here is some of the top cap coins that entered 2017, and the amount they returned by holding, no trading involved. (Author note: Cardano, Bitcoin Cash [Bcash], and IOTA all entered the market after June 2017.)

There were many coins that did 30x, 40x, 50x (US Dollar return, not Bitcoin return) in 2017, and all you had to was hold. That is the key to this game. For most large cap coins (coins above a $10 billion market cap) I wouldn’t expect more than a 1,000% gain in 2018 at the most. If you want big returns, you have to find coins that have small/micro market caps. It’s the easiest way to see a 10,000% return.

Your investment multiple gets decreased each time a coins market cap increases. For instance if you buy a Coin A at $1 million market cap versus Coin B at $5 million market cap, and you sell when it hits $100 million market cap, here is your return difference: Coin A = 10,000% & Coin B= 2,000%.

That’s a big difference. If you put $1,000 into each coin, Coin A’s value would now be $100,000 and Coin B’s value would be $20,000. Both are great returns, but one clearly did much better than the other.

Going Forward

The market cap for crypto is still a drop in the bucket compared to other markets. For instance, total gold market cap is around $8 trillion (store of value) and the NYSE is valued around $21 trillion per NYSE Data. My conservative guess would put the top of this crypto market around $10 trillion before we see a long-term bear market. This may seem quite large, but considering cryptocurrencies use case as a store of value, it could replace offshore bank accounts. There is an estimated $21-$32 trillion stored in offshore accounts per Tax Justice Network.

Privacy coins will become all the more important in 2018 as people look for a place to store their assets and money in something similar to a “Swiss bank account.” I expect privacy coins like Monero, Zcash, Zencash, Sumokoin, and more to thrive this year as more people look to move their assets and money anonymously. One gross misunderstanding of Bitcoin is that it is “anonymous” or pseudonymous. Every wallet and transaction can be viewed on the network via a Block Explorer.

The biggest issue facing cryptocurrency at the moment is scalability. Networks simply cannot handle the demand being put on them by all the new users coming in. A good example was CryptoKitties. These guys managed to clog the Ethereum network back in early December, going to show that Ethereum’s network is not ready yet for wide public use. Vitalik Buterin, Ethereum’s Co-founder, spoke about how over a year ago he use to be so evangelical about getting the word out, but now knows that’s not the issue. The issue is scaling.

Things to keep in mind: the swings and the dips are only going to get larger from here. Recently we just shed $400 billion which was more than four times the size of the market cap 6 months ago. Once we enter the trillions, it is very possible we could see a swing in the magnitude of near a trillion dollars. Though these will take longer to build, granted cryptocurrency is moving parabolically as more people adopt and use the technology.

Disclaimer:

- This author currently owns some XRP (Ripple) & Sumokoin.

- The views expressed in this article are solely the author or analysts and do not represent the opinions of the author on whether to to buy, sell or hold shares of a particular cryptocurrency, cryptographic asset, stock or other investment vehicle. Individuals should understand the risks of trading and investing and consider consulting with a professional. Various factors can influence the opinion of the analyst as well as the cited material. Investors should conduct their own research independent of this article before purchasing any assets. Past performance is no guarantee of future price appreciation.

This is a Contributor Post. Opinions expressed here are opinions of the Contributor. Influencive does not endorse or review brands mentioned; does not and cannot investigate relationships with brands, products, and people mentioned and is up to the Contributor to disclose. Contributors, amongst other accounts and articles may be professional fee-based.