The Sotheby’s auction house has recently been named as a defendant in an ongoing class-action lawsuit that was amended on August 4th. The lawsuit alleges that Sotheby’s, Yuga Labs, Moonpay, a Hollywood talent agent, and a large list of celebrities were all involved in a “vast scheme” to unlawfully promote and sell digital securities offered by Yuga Labs.

The lawsuit lists that Yuga Labs colluded with Sotheby’s as the first step towards inflating the price of their Bored Apes NFT collection.

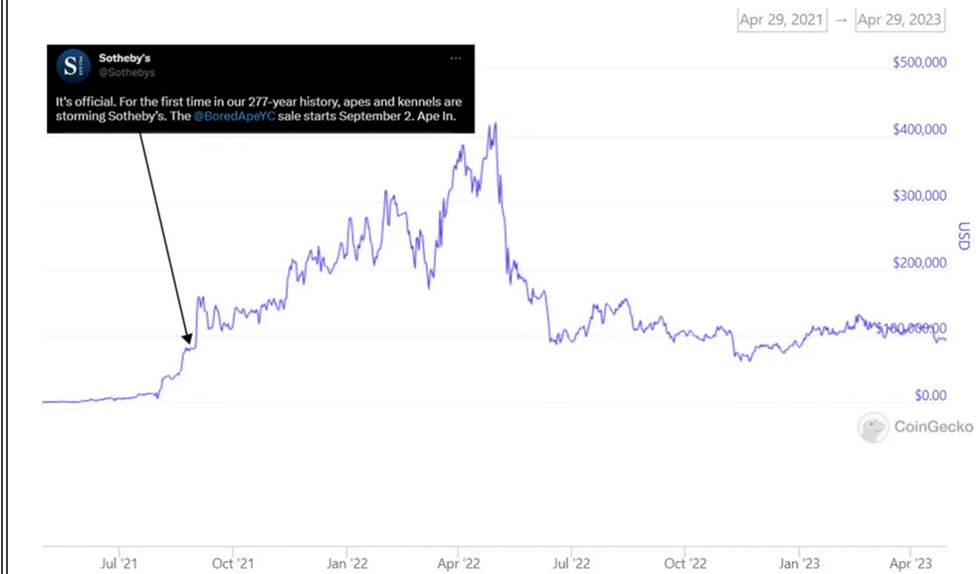

101 Bored Apes were auctioned in Sotheby’s “Ape In!” auction starting on September 2nd, 2021. The lawsuit states that representatives of the auction house “misleadingly promoted both the auction and the BAYC NFT collection” through social media and news statements.

Max Moore, Sotheby’s Head of Contemporary Art Auctions, is listed as a primary example of the alleged offense. Moore tweeted an animation of a golden Bored Ape walking his golden dog from the Bored Ape Kennel Club on August 27th, 2021- one day before Sotheby’s would post the same announcement on their official Twitter (or X?) account.

— Max Moore (@MaxMoore_Art) August 27, 2021

Announcements are not inherently unlawful. The lawsuit alleges, however, that Sotheby’s additional actions implicate them as part of the overall conspiracy to inflate the price of Yuga Labs’ digital assets.

The NFT collection sold for $24.4 million to an anonymous bidder. This price meant each Bored Ape sold for more than $100,000 above the floor price at the time. The lawsuit credits this as a contributor to the explosion in the price of the collection.

Moore apparently told listeners during the September 9th, 2021 Rug Radio Twitter Space that the collection was auctioned off to a “traditional collector.” This is stated to have brought legitimacy to the high price of the Bored Ape collection by insinuating the collection had reached a mainstream audience.

Sotheby’s Co-Head of Digital Art Sales, Michael Bouhanna, declared afterward that “the NFT market is not a bubble” and that naysayers were being “proven wrong… it’s a very organic market with great collectors who have great appreciation of art.”

The largest issue against Sotheby’s “traditional” and “great” collector is that an alarming amount of evidence points towards the fact that the winning buyer of the collection was a rather infamous one- the now-defunct cryptocurrency exchange FTX.

Prior blockchain transaction history tied the wallet that was sent the auctioned Bored Apes directly to the notorious exchange. Additionally, upon the launch of FTX’s NFT platform, all 101 of the auctioned BAYC NFTs were listed for sale.

The lawsuit also claims that Sotheby’s did not solely stand to benefit from the auction by the high selling price alone. According to Moore, “sales [of NFTs] should help Sotheby’s attract new collectors who may not have interacted with the house before.” The auction house then went on to open “Sotheby’s Metaverse,” an NFT trading platform, in October 2021. The lawsuit claims it is believed that this platform was operated as an unregistered broker of securities.

Allegations against Sotheby’s are only a small part of the lawsuit. If the claims are true, the picture painted in the case is one of the largest conspiracies devised in the cryptocurrency space. Implicating prominent names such as Jimmy Fallon, Paris Hilton, Justin Bieber, Post Malone, and Snoop Dogg, interested readers should review the case for themselves.

This is a Contributor Post. Opinions expressed here are opinions of the Contributor. Influencive does not endorse or review brands mentioned; does not and cannot investigate relationships with brands, products, and people mentioned and is up to the Contributor to disclose. Contributors, amongst other accounts and articles may be professional fee-based.