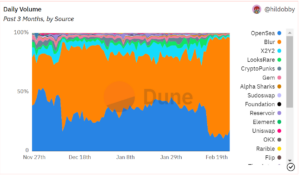

NFT marketplace Blur.io appears to currently be the hottest object of interest in the Web3 space. Since its launch in October, Blur’s trading volume had been keeping up with OpenSea’s thanks to the promise of a future airdrop of the marketplace’s own token. The trading volume on the self-billed “Fastest NFT Marketplace” kept climbing until now, at present, Blur’s trading volume accounts for almost 80% of total daily trading volume.

CryptoSlam.io, the world’s first multi-chain NFT data aggregator, says to not believe the hype. According to them, at least $577 million worth of NFT sales on Blur are wash trades. Scott Hawkins, a data engineer at CryptoSlam, states that these wash trades were discovered by exhibiting suspicious behaviors, such as NFT resales within a short period at prices close to the assets’ initial transactions. This behavior implies that users are selling NFTs to themselves using different wallets.

Some stories of the past week:

⚡️We're taking action to remove over $500 Million in wash trades, retroactively as well as applying an updated algorithm to prevent future wash trades.

⚡️@blur_io's founder, @PacmanBlur, revealed his identity after the https://t.co/eq6wE90BSH… https://t.co/dDQ6iTUUuk

— CryptoSlam! (@cryptoslamio) February 25, 2023

Gamifying the airdrop is seen as the sole motivator for this behavior. Blur had been rewarding users with their token for listing NFTs on their marketplace, but their newest criteria for the airdrop has been rewarding tokens based off of bidding activity. With the average airdrop being worth $2,877 at the current token price of around $.85, it is no surprise that many users with large wallets would be tempted to engage in these false practices.

“There is no restricting mechanism from Blur to prevent this — in fact, it appears that because of no royalties paid, no marketplace fee, there is no disincentive to farm points for airdrops, aside from the rising Ethereum gas fees,” said Hawkins.

Speaking of the lack of fees, Blur’s 0% marketplace fees and drastic amount of trading volume has prompted OpenSea to match their marketplace fee and reduce their enforced royalties to 0.5% for a “limited time.” Kofi Kufuor, a contributor to the DeFi Llama and former partner at 1confirmation, a venture firm, believes that this will not help OpenSea. In a statement to The Defiant, Kufuor said that he believes “the more creator-focused demographic of the NFT space liked that OpenSea was still trying to stand up for royalties. So the decision [to lower royalties] didn’t bring in any users or volume from that group. Pro traders were already getting 0 fees and 0.5 royalties on Blur AND Blur gave them free money. If they moved they would get the same fee rates, but would be missing out on free money.”

Kufuor is also one of several people taking to Twitter to bring attention to another alarming statistic; over half of Blur’s trading volume appears to be solely from around 300-500 wallets. If this is true, this would indicate that only a small group of individuals are having a rather large impact on the prices, volume, and business practices being exhibited in the world of NFTs over the past month.

53% of Blur's volume comes from just 500 wallets

(research by Archmage @jphackworth42 🧙✨)

The marketplaces are killing their profits, long-term relationships with creators and future growth prospects to compete for ~500 pro traders

— Kofi (@0xKofi) February 21, 2023

Hey! Here are some fun facts about NFT volume:

20% of Blur's volume comes from only 15 wallets.

50% of Blur's volume comes from less than 300 wallets.

Watch the top 500 farmers drive artificial volume live over any timeframe with source below ⬇️ pic.twitter.com/chDM6B7uMv

— poof (@poof_eth) February 22, 2023

Blur’s remaining time in the spotlight remains to be seen. Last year, NFT marketplace LooksRare was the subject of much frenzy during its own airdrop- it currently has a daily trading volume of less than 1%. This time could be different, however. Perhaps OpenSea finally has a competitor… or perhaps investors are just watching another instance of the rich getting richer.

This is a Contributor Post. Opinions expressed here are opinions of the Contributor. Influencive does not endorse or review brands mentioned; does not and cannot investigate relationships with brands, products, and people mentioned and is up to the Contributor to disclose. Contributors, amongst other accounts and articles may be professional fee-based.