[playht_player width=”100%” height=”175″ voice=”Richard (en-US)”]

Exchanging money in return for a good or service has come a long way – from payment methods that are slowly being phased out like cheques to the still-in-style cash, to futuristic payment methods and money of the future like digital assets such as Bitcoin. In 2019, there are several ways you can pay for the good or service that you are interested in buying. However, even though there are a variety of ways that you can pay for your good or service, the payment methods that remain the most popular seem to be reluctant to give up their spots or switch positions when it comes down to the 5 most popular ways to pay for a good or service – at least in the United States of America.

America’s Most Popular Payment Methods

Throughout time, different payment methods have arisen, each being an innovation, more efficient, and making the lives of consumers easier than the last. From the cheque, which hit the market in the 17th century, to the more modern electronic payment services that are popular with younger generations, the way that consumers pay for goods and services has evolved.

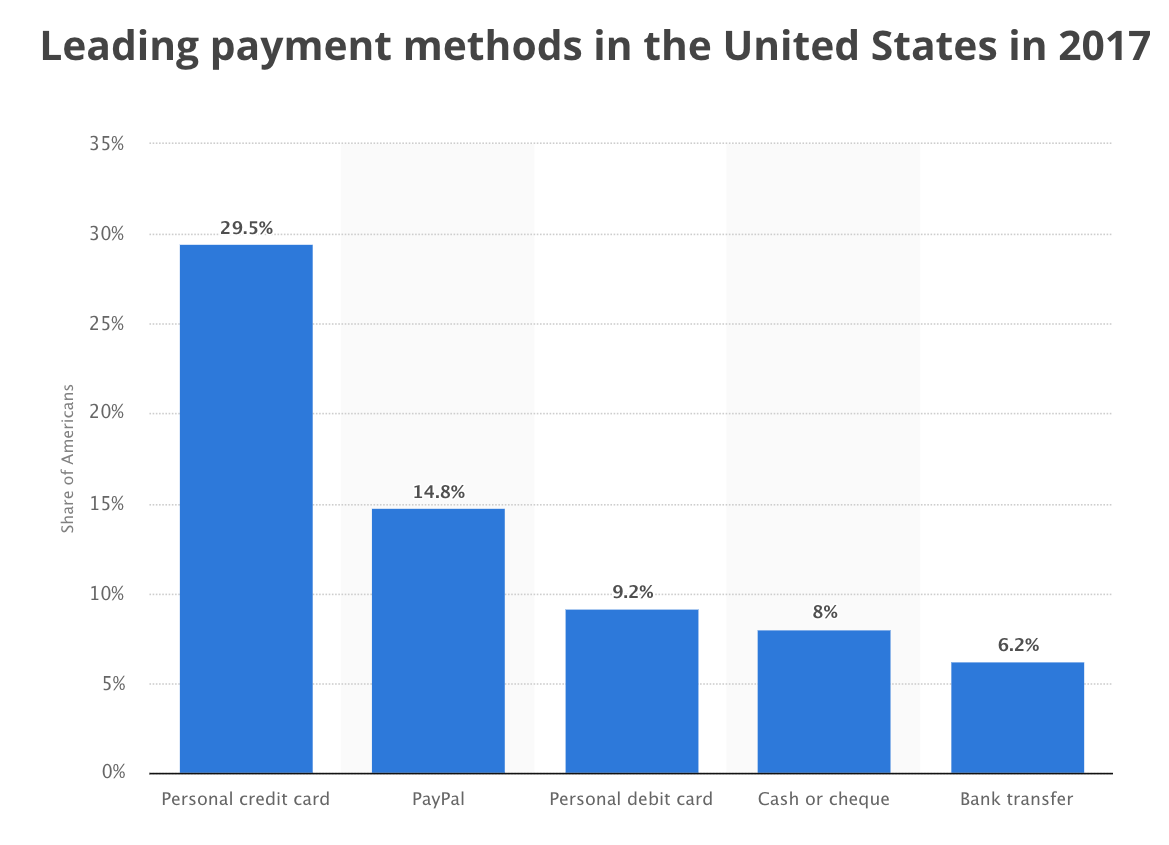

Nonetheless, these changes happen slowly but surely. And as technology has gotten better, innovations of the future are created and hit the market, faster than they previously could. But, when you rank the payment methods that a majority of consumers prefer to use, there seems to be a consensus when it comes to the payment methods that Americans prefer to use the most. A 2017 study from Statista reports that credit cards, electronic payment services (specifically PayPal), debit cards, cheque, and bank transfers, in that order, are the most popular ways Americans prefer to pay.

When we reached out to professionals in the payment space for insight regarding the payment methods Americans use most and why they may rank the way they do, Logan Murphy, the CIO of Currency said:

“Electronic payments are continuing to rise in popularity due to eCommerce and the convenience it provides buyers. Bank transfers, on the other hand, will continue to decline in popularity as more convenient sales and payment methods offer better security on big-ticket purchases. CurrencyPay [has noticed that when it comes to] large-ticket transactions, credit card and financing options [prove] to be the most popular forms of payment. If a merchant wants to increase sales, it’s very important to offer multiple checkout methods, as this makes the buying decision easier for potential customers.”

Thanks to the internet and E-commerce, digital and wireless payment methods have gained traction, while those that are more hands-on like bank transfers seem to be going out of style. Nonetheless, what experts within the payment space see is that the most popular ways to pay are still the payment methods that don’t require the consumer to actually have sufficient funds in their bank account.

Let’s take a closer look.

Source: Statista

Credit Card

Credit cards are the most popular payment method when it comes to buying goods and services in America. One reason for this may be because when you pay with credit, you don’t actually need to have the sufficient amount of funds in your bank account to make the purchase; this could be especially useful if you need to make an emergency purchase – like a bill from an unexpected hospital visit. In addition, when you pay with a credit card, you have the option to finance the purchase you made, paying off the total expense in a series of installments rather than in one shot. This is most likely appealing to many individuals and may be another reason that credit cards are the most popular way to pay for goods or services in America.

Electronic Payments

Electronic payment methods like Paypal, CashApp, and Venmo are becoming increasingly popular, especially among younger generations, and rank #2 as the most popular payment method in America (specifically Paypal). One reason for this may be because we live in a digital world that is increasingly becoming a place where more and more electronic devices connected to the internet are being created and carried by individuals. That being said, payment methods that are available through the internet, like Paypal, are bound to be popular – especially because they make it easier to transact with individuals in foreign countries as well as those in your native country.

Younger generations grew up in a world with devices connected to the internet from the jump, so it would not be surprising to see this payment method climb the ladder and rank at #1 some point in the future.

Debit Card

Debit cards are the 3rd most popular payment method in America. Using a debit card is the digital equivalent to paying by cash or cheque. Debit cards allow you to have the convenience of a credit card in the sense you that you don’t need to carry bulky cash or a cheque book; however, they also require you to actually have the sufficient funds in your account to make a purchase. Although popular, this may be why debit cards rank relatively lower than credit cards on the list. Requiring individuals to have the sufficient amount of funds to make their desired purchase may require more time for the individual to accumulate wealth rather than paying with a credit card and paying off the purchase in a series of installments.

Cash/Cheque

Cash/Cheque is the 4th most popular payment method in the United States; paying via cash or writing out a cheque is age old and time tested. Although cash is falling out of favor with many individuals, especially younger generations who grew up with electronic devices that can connect to the internet, nearly every business is willing to accept cash – even though some don’t accept credit or debit or have spending limits before you are allowed to pay via these methods.

Bank Transfer

The age-old bank transfer ranks in at #5 when it comes to how consumers in America prefer to make their purchases. Given all the new and innovative ways that have been created that allow people to transfer wealth from one peer to the next, it is no surprise that the bank transfer comes in last – after all, the bank transfer has been in use since the mid to late 1800s!

One reason that bank transfer might come in last in this modern day may be because it takes several steps to complete a bank transfer. For example, most of the other methods pretty much only require you to do straightforward processes. For instance, swipe a card, exchange tangible money, or enter a recipient’s email address. However, a bank transfer requires you to know the routing number of your bank, as well as your own bank account number, as well as the routing number and bank account number of the recipient. This is information that the average individual usually does not know off the top of their head or carry around in their wallet. That being said, before the more modern innovations listed above hit the market, the bank transfer had its reign.

So Which Method Is the Best?

Although the American audience has its preferences when it comes to payment method of choice, each of the payment methods listed above may be optimal depending on the situation the consumers find themselves in.

For example, a car dealership probably isn’t going to let you purchase an $80,000 car in cash. The average American does not keep $80,000 in cash, and trying to make a big ticket purchase in this manner is likely to raise a few eyebrows regarding the legality of your funds. However, the relatively unpopular method of bankers cheque would be perfect for a situation like this.

It might not make sense to try to pay for a $.50 piece of candy with a credit or debit card – especially because the expense to the merchant for working with a payment processor is likely to be more than the value they receive from your purchase – but using cash in a situation like this would be perfect.

And if you owe your friend money, it is not going to make sense to initiate a bank transfer, but rather, you will probably settle your payment with the friend through an electronic payment service like Venmo or CashApp, or give them cold, hard cash in return for spotting you.

As you can see, even though some payment methods are more outdated than others when it comes to making a purchase, each payment method indefinitely has a time and place where it can be used in this world. And although some of these methods are going out of style, it would not be surprising to see innovations pop up that take their place and are more efficient for consumers to use.

This is a Contributor Post. Opinions expressed here are opinions of the Contributor. Influencive does not endorse or review brands mentioned; does not and cannot investigate relationships with brands, products, and people mentioned and is up to the Contributor to disclose. Contributors, amongst other accounts and articles may be professional fee-based.