In a recent speech at the 22nd BIS Annual Conference, Fabio Panetta, a Member of the Executive Board of the European Central Bank, highlighted what he believes are the shortcomings of the crypto industry and, unsurprisingly, called for regulatory safeguards to address its “market failures and negative externalities.”

Panetta emphasized the need to move beyond the “illusion of crypto-assets as easy money and recognize them for what they truly are: a form of gambling.” However, many of the points made in the speech lacked context or additional information. It must also be said that the irony of such comments coming from a body which has seen their currency devalued at breakneck speed cannot be ignored.

In the interest of fairness, let’s take a look at what was glossed over, or not mentioned at all.

There Is No SEcond Best

First of all, Panetta appears to reveal in the first line of his speech that he is privy to something that the rest of the entire world isn’t; Satoshi Nakamoto’s origin story.

“Some 15 years ago, software developers using the pseudonym Satoshi Nakamoto created the source code of what they thought could be decentralised digital cash.”

Panetta here implies that more than one person was Satoshi, which is certainly a theory but not an ordained fact. Panetta ran with it anyway in front of a capacity crowd while representing the European Central Bank.

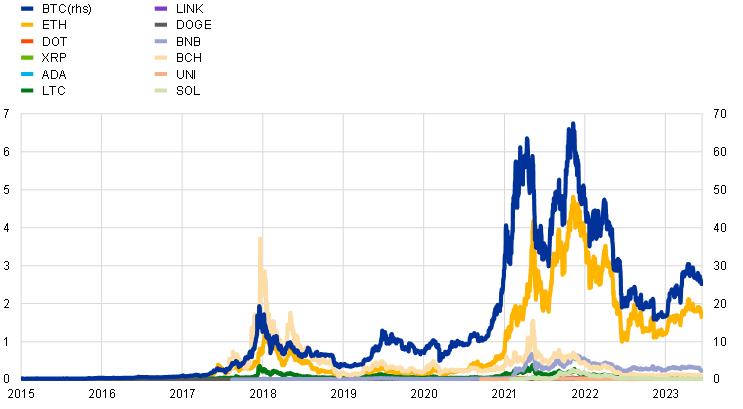

With that mystery now solved, Panetta goes on to detail how many lost money during the market crash of 2022 and have lost faith in the idea of crypto. Admittedly, there is much truth to this. However, it’s worth noting that Panetta’s chosen chart to illustrate the pullback from the 2021 highs also includes prices dating back to 2015. Ironically, this inadvertently showcases how Bitcoin and crypto have been the top-performing asset class over the past decade.

Financial markets, whether traditional or crypto, are prone to cycles of ups and downs. By painting the price volatility as a failure of crypto, Panetta failed to acknowledge that investing in any asset carries risks and that losses are a part of the game. Besides, if we follow Panetta’s logic, stocks would also be considered pure gambling. Yet, that’s far from the truth.

Expert traders and investors rely on news, charts, and thorough research to make informed decisions about the companies they put money in. The same principles can be applied to crypto investments. Indeed, there’s an undeniable gambling element to crypto, but labelling the entire industry as such based on that alone is facetious.

Consider the shady manipulation, or rampant insider trading that happens in the stock market, along with the baffling market halting feature controlled by some centralized authority which can be switched on at any given moment. Is this our shining beacon of light when it comes to an example of a fine and healthy regulated market?

🧵Crypto has relied on constantly creating new narratives to attract new investors, but has failed to deliver on its promises. Policymakers should be wary of supporting an industry that has so far produced no benefits for society.

Read the speech https://t.co/okum8fH3qf

1/3 pic.twitter.com/40OlefVExB

— European Central Bank (@ecb) June 23, 2023

“Slow, expensive, and provides no societal benefits”

Panetta argued that transacting on blockchains can be inefficient, slow, and expensive, citing it “the blockchain trilemma.” However, he glossed over the numerous projects that have emerged to successfully address these issues, such as layer-two scaling solutions, saying simply “they have drawbacks of their own.” Not an untrue statement, but no elaboration given.

Panetta went on to argue that crypto assets have not provided any societal benefits. This statement ignores the numerous innovations that have emerged from the crypto industry which offer financial services to people who are excluded from traditional banking systems.

Furthermore, Panetta expressed concerns about the ecological impact of crypto mining, particularly in relation to proof-of-work. While it’s true that certain mining processes still leave a lot to be desired, he failed to acknowledge the ongoing efforts to transition towards more sustainable methods like proof-of-stake. Interestingly, Panetta made no mention of the environmental impact of gold mining, which far outweighs that of Bitcoin.

Final Thoughts

In a completely predictable conclusion, Panetta’s skepticism culminated in a call for rigorous regulatory standards. It always does.

There is much to criticize the crypto space for, and it would be foolish for even the most ardent supporter of Web3 to say change is not needed. However, it would be just as foolish to call for the change to be dictated by a body of individuals who a) stand to lose a great deal of power if the regulation is not heavily weighted in their favor, and b) have failed with economic policy on their own turf.

While some of Panetta’s points may stem from a genuine desire to protect investors – one at least hopes so – it’s difficult to fully trust our leaders when faith in them is at an all-time low. The public has witnessed a lack of prioritization when it comes to safeguarding their interests, not just financially, but in almost all areas of life in recent years.

Opinions expressed here are opinions of the Author. Influencive does not endorse or review brands mentioned; does not and cannot investigate relationships with brands, products, and people mentioned and is up to the Author to disclose. Accounts and articles may be professional fee-based.