The upcoming hard forks for Bitcoin have not received near the coverage of the past three hard forks of Bitcoin: Bitcoin Cash (Bcash), Bitcoin Gold (BTG), and the canceled SegWit 2x fork (some thought it was postponed, including myself due to the confusion caused by the SegWit2x “2.0” fork, read more on it below). There are reasons for this; firstly, they haven’t had the same effect among the community (drama, just look at Bitcoin’s community split between Bitcoin and Bitcoin Cash, it’s ridiculous) and secondly nowhere near the same proponents like Roger Ver and Jihan Wu behind Bitcoin Cash, big influencers in the Bitcoin and greater crypto community. They along with Bcash fans view Bcash as the real vision of Satoshi Nakamoto.

One thing anyone must note is treating forks of Bitcoin like altcoins. Despite the recent FUD (Fear, Uncertainty, Doubt) around Bcash and Bitcoin, you must understand their is only one Bitcoin. This doesn’t mean a fork like Bcash or BTG won’t be successful.

How do “I” receive BTCP?

What makes Bitcoin Private (BTCP) different about it from previous forks? Owners of both Bitcoin and ZClassic (ZCL) will receive BTCP at a one-to-one ratio upon the snapshot of the network. For example, if you own 10 Bitcoins and 30 ZCL, you will get 40 BTCP. For those unaware, ZCL is a privacy coin based on Zero Knowledge proofs (ZKP) that was forked from Zcash.

In order to receive BTCP, it is recommended you store your ZCL and Bitcoin in private wallets to guarantee you receive your tokens. ZCL’s only major exchange it is listed on is Bittrex, but Bittrex is yet to announce if they will support the fork.

The total circulating supply for BTCP will be 18,500,000 (Supply BTC + Supply ZCL) with a max supply of 21 million BTCP. The tech of BTCP will be that of Bitcoin Gold, but also with parts from Zcash/ZClassic. Payments for BTCP will be published on a public ledger, but the amount, sender, and recipient of the transaction remain anonymous.

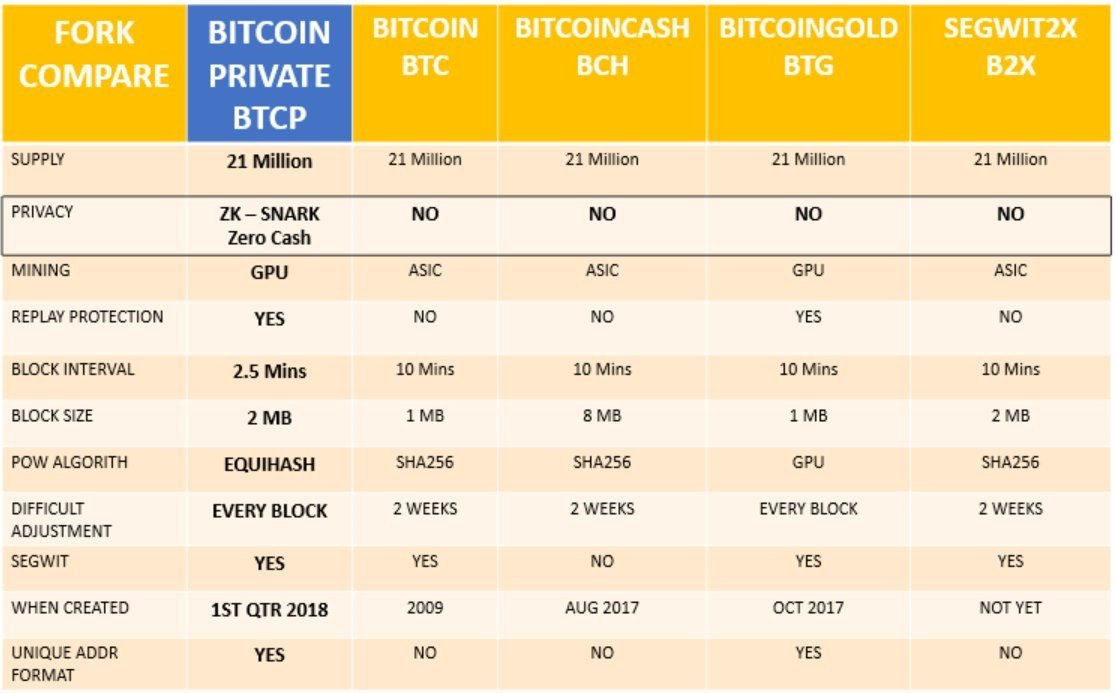

Author Note: In the chart comparison above, Bitcoin Gold uses a Equihash PoW Algorithm.

The founder of ZClassic, Rhett Chreighton is also the creator of BTCP. Rhett Chreighton had announced on Twitter in early December that he was teaming up with the original Zclassic founder Joshua (name on the Twitter account), who goes by the name Movrcx. The tweet stated that they were working actively on ZCL, and what they were working on was a purely mined fair launch ZK-SNARK tech with no founders reward.

ZKP offers the advantage of hiding the amount a wallet or individual may have. It is a way for a “Prover” to exchange a message with a “Verifier” to assure them that they have knowledge of a certain proof without declaring what that knowledge is.

There are parameters that must be satisfied for ZKP to work:

- Completeness: If the statement is true, then an honest verifier can be convinced of it by an honest prover.

- Soundness: If the prover is dishonest, they cannot convince the verifier of the soundness of the statement by lying.

- Zero-Knowledge: If the statement is true, the verifier will have no idea what the statement actually is.

ZClassic Price Reaction

The market’s response to ZCL being part of the BTCP fork was nothing short of spectacular. In less than a week, ZCL went from roughly $7.50 all the way up to $120, a 1600% price change, taking it from a $4.5 million market cap to a $217 million market cap. Some would call it euphoric and FOMO, but with ZCL price now stabilized around $80, I only see it going up from here. For one, the BTCP hard fork is not till mid-to-late January. As the fork approaches, many people will choose to stack ZCL versus Bitcoin because they can obtain ZCL much cheaper, thus more BTCP.

ZCL price made a healthy correction to around $80, so I expect it to consolidate over the upcoming days and continue it’s uptrend as more people will pile into ZCL to get their “free” BTCP. With such a low circulating supply (1.8 million ZCL), it will move up fast once more people start trying to get their hands on it. A $1,000 ZLC is not out of the picture considering it would only have to see around a twelve times jump. With its current market cap at $161 million, that’s not unfeasible.

I will say this- expect a hard dump after the BTCP snapshot. Many people will be buying up ZLC for the fork soon, so be weary if you decide to invest.

More Forks

There have been already a few forks of Bitcoin in December and more to come including:

- BitcoinX (BCX) – A smart contract based Bitcoin, akin to Ethereum and NEO. It also includes zero-knowledge proof and Delegated Proof of Stake (DPoS) consensus. The snapshot has already occurred at block 498888, no coin released.

- Super Bitcoin (SBTC) – Similar to BitcoinX, smart contract based Bitcoin. According to their website, it has lightning network, zero-knowledge proofs, and bigger blocks (bigger than Bitcoin). The snapshot already occurred at block 498,888, no coin released.

- Bitcoin Platinum (BTP) – Per their website, BTP is “Satoshi’s original vision of Decentralized Electronic Cash.” There are rumors though that BTP was a scam set up by a South Korean teenanger. The snapshot already occurred around blocks 497,757/498,533.

- Lightning Bitcoin (LBTC) – A fork that is meant to provide “lightening fast payments.” It uses smart contracts similar to Ethereum and NEO. It uses DPoS consensus according to the website. Supposedly its block design could support 1,000 to 10,000 transactions per second, but that’s still theoretically not tested yet. The snapshot already occurred at block 499,999.

- Bitcoin Cash Plus (BCP) – According to their website they are “fulfilling the original promise of Bitcoin as Peer-to-peer Electronic Cash.” The snapshot occurred at Block 501,407.

- Bitcoin God (GOD) – No premine, central team, smart contracts, larger blocks (larger than Bitcoin), PoS (Proof of Stake) mining, lighting network enabled, and zero-knowledge proofs. Snapshot occured at block 501,225, no futures trading yet.

- Bitcoin Segwit2x “2.0” – The original Segwit2x fork was to occur at block 494,784 in earlier November, but was canceled last minute at the end of October. This version of Segwit2x appears to have no direct relation to the previous Segwit2x fork outside of the name (this is why it is of the utmost importance you do your due diligence when looking to invest/buy a coin, as names can be similar or nearly the same but have absolutely no relation). This post on Medium covers the confusion well that this second Segwit2x fork has caused. Even I was confused at first, thinking it was the original 2x fork, just postponed. Masquerades and get rich quick ponzi schemes like these confuse the market and hurt small investors. Please be careful when investing and always do your own research.

My biggest issue with many of these hard forks is they are just riding off the band wagon of Bitcoin. Using the Bitcoin brand to grab attention and with the amount of new people flowing into cryptocurrency, it is very easy for them to get them confused. As I stated previously, treat all forks like altcoins, nothing more, nothing less.

If you want to read more articles of mine please check out my blog on Steemit! I post here a little more frequently since it is easier for me to push out articles. For those who don’t know, Steemit is a blockchain based social platform that is like a hybrid of Reddit and Twitter where content creators and curators get paid. I highly recommend you check it out and give it a try.

Disclaimer: The views expressed in this article are solely the author or analysts and do not represent the opinions of the author on whether to to buy, sell or hold shares of a particular cryptocurrency, cryptographic asset, stock or other investment vehicle. Individuals should understand the risks of trading and investing and consider consulting with a professional. Various factors can influence the opinion of the analyst as well as the cited material. Investors should conduct their own research independent of this article before purchasing any assets. Past performance is no guarantee of future price appreciation.

This is a Contributor Post. Opinions expressed here are opinions of the Contributor. Influencive does not endorse or review brands mentioned; does not and cannot investigate relationships with brands, products, and people mentioned and is up to the Contributor to disclose. Contributors, amongst other accounts and articles may be professional fee-based.