Yes, you read that right.

When you were 16 years old, you had something near and dear to your heart and that you loved….

For me, it was Mario Kart.

For Mustafa Chaudry, trading guru, it was the moment he discovered this idea of making money online.

And something about it instantly hooked him.

But that’s not how it started….

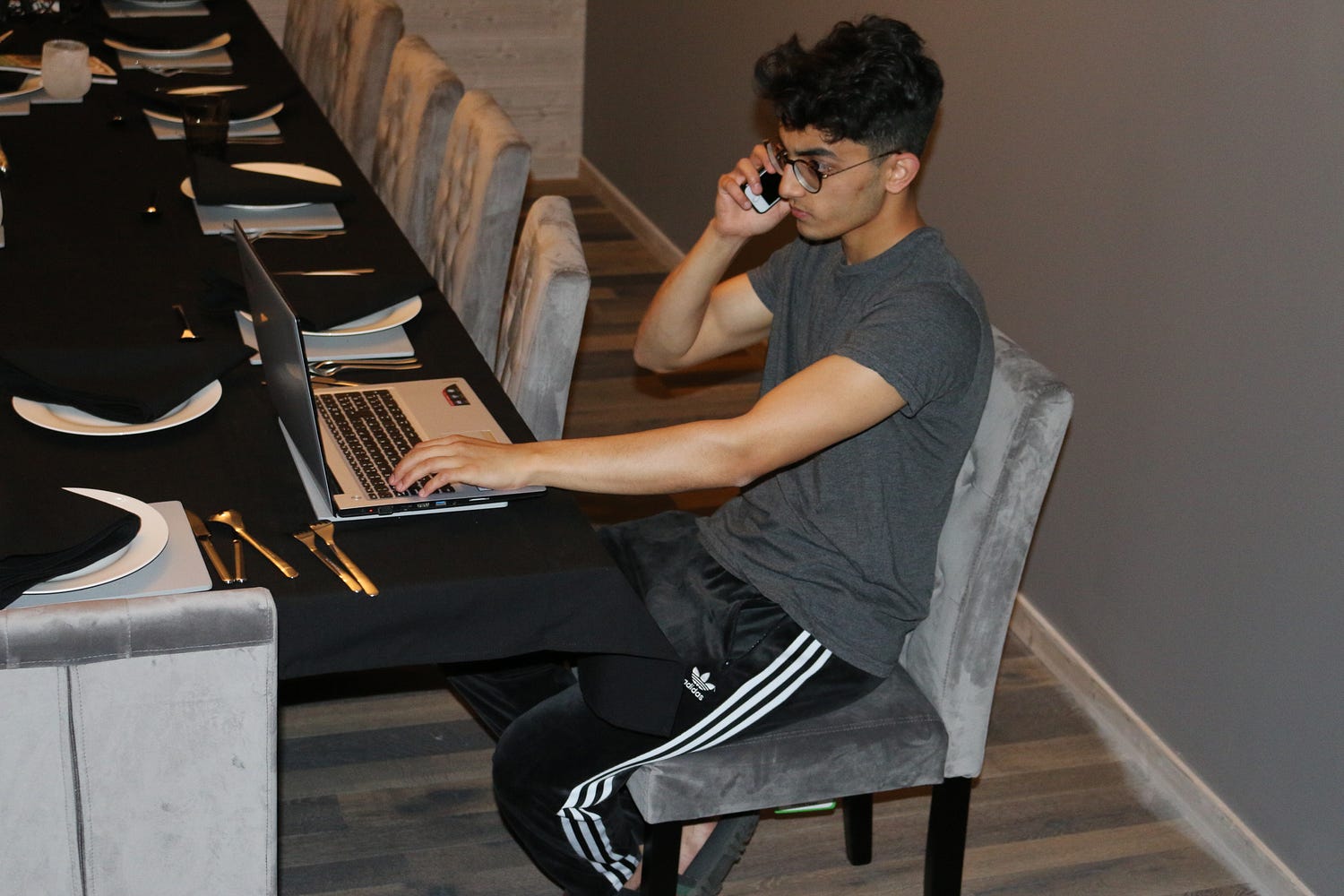

When he was 16, he sat down and learned everything there is to know about the new trend of generating income online and leveraging social media. And this research paved the way to his first start-up business in e-commerce drop shipping. He was blown away by this concept of working away from a 9–5 job and working from home instead.

Cracking the code to success has its frustrations, but it didn’t stop Mustafa. Before he knew it, he was generating 5,000 dollars a month through ads on social media like Facebook, Snapchat, etc.

Let me explain.

Mustafa knew the 9–5 job trend that ate up most people’s lives, but he knew he’s meant for more. He was inspired by the idea of making residual money from home, so he built an office there. Determined to crack the code to success, he almost cracked his back working endless hours at his desk.

But wait. There’s more.

He wrote out a long list of all the social media experts in his circle of influence. He made a conscious effort to reach them and seek guidance. He was getting the results that he knew people would pay to get. He knew he was on to something profound.

Now here comes the good part…

After drop-shipping for over a year, he sold all his stores online to focus on more lucrative ways of making money — aside from college. And this was the ultimate treasure chest he had been looking for since he was 16. Without this discovery, his name would be unknown to the thousands of people that invest in his courses.

Ready for it?

Trading.

Yes, you read that right.

It was the selling and buying of currencies and commodities.

You may ask yourself why a college student would be pursuing such an avenue of life. And it’s a good question. Here are Mustafa’s own words:

“Although I made a lot of money through my businesses, I still have aspirations to pursue a business management degree, and thus it makes the most sense for me to focus on my studies so that I have as many achievements as possible under my belt.”

Mustafa was doing it right.

The Forex market works with respected financial institutions — the main players in what has become the world’s largest marketplace. It’s simple. Traders buy and sell currencies as they rise and fall in value. And over 5 trillion pounds are traded daily, so investors like yourself can take home some profit.

And such a market gave Mustafa the time, energy, and effort to focus on his studies.

When getting into Forex trading Mustafa stressed that the hardest part of it all was convincing his parents to activate a Custodial account for him — as there is an age limit of 18 for investors when entering the markets. He responded:

“No one had belief in Forex trading, and they all thought that it was some scam.”

Well, what would you do if your family said this to you? Just shut the door on your dreams? Here is what Mustafa did.

Mustafa craved mentorship from players in the trading game already. He invested in himself. He completed online courses and ingrained everything there is to know about trading into his life.

As the old saying goes…

“Learn how to swim before you take a cruise.”

He was setting himself up for success. This was just the beginning.

He said:

“When I first started college, I remember the teacher having to warn me many times to stop going on my phone. I was closing off trades that made me 100s of pounds of profit during school, but then I realized I should be focusing on my studies during school and Forex after.”

Mustafa was all in.

He started out in the Forex market with over two times the lowest amount required. But he gradually deposited more and more money once higher profits started to come in. Here is what he told me:

“I started with only 500 pounds, the smallest deposit was 120 pounds, but I wanted to have a higher leverage when trading, as higher leverage meant I could buy a larger stock quantity.”

He didn’t stop there.

“Once I saw the true potential of trading Forex, I invested a lot of my assets from previous businesses into this account. I was hesitant at first. I was new to trading currencies. I was dipping my toes in the water. I didn’t want all my eggs in one basket. I started with more than most people, though. Trading is a risky game in and of itself.”

Mustafa has planted many seeds throughout his journey.

One year ago, he sat in college chasing a management degree.

He studied e-commerce.

He launched a drop-shipping business.

He studied that.

He leveraged social media.

Then he discovered trading.

He studied that.

He certified himself.

Now, he generates the kind of money that beats the average household income in America in a single month.

Mustafa recently started to branch out and create a powerful brand for his name.

As being once a student of a course, Mustafa created one. He shows you how to make money trading using his easy methods with the most popular market that exists. He said:

“My aim is to help people earn a second source of income. I sell these courses and I help people learn how to analyse the charts and predict when certain currencies will increase or decrease. And I always stress to people that once you master this skill no one can take it from you. So it can be applied anytime to make money anywhere, for any reason.”

Crazy right?

18 years young. Mustafa. In his last year of college. A new passion. A new beginning. A new role in life. He tells us:

“I started to teach people and found it rewarding. I now issue educational Forex courses in collaboration with a bigger company.”

Hold your horses. It doesn’t end there…

Mustafa has further mentioned plans of an EA, Expert Advisor, that he and his software team have been working on. He talked about new additions to the course. For example, future property courses and automated trading robots (currently in development) that scan and analyze the markets based on his trading style.

He adds:

“My team and I are working on an EA that analyzes the Forex market to find specific patterns such as the Gartley Butterfly. It does this by using the ZigZag indicator and accumulated data from past price movements and data recorded.

He added,

“This is great as now my trades will be automated, so I can make residual money while studying. I am looking to make this software public, but first we have to surpass the beta stages.”

This is the part that will revolutionize trading for people like you all over the world

“My team and I are looking into MAM , Multi Account Management, whereby my trades replicate to other accounts. This allows you to invest in your private account. How do I do it? By automatically cloning my trades onto your account. Not only does this buy you time, but we become partners in business and both make money. I am learning as many skills as possible so that I have an array of knowledge when I am older, and then I can just implement what I already know to make money no matter what.”

So, what are Mustafa’s 5 tips for someone who wants to live a life of financial freedom?

1. Learn a Skill That Can Pay You for Life

If I haven’t said it enough, a skill is one of the best investments you can make in yourself. It costs practice and, when applied, makes you profitable in every area of your life. Whether it be learning how to play the guitar, studying theatre, or becoming the best accountant – whatever the case may be – there is no right or wrong skill you can learn. The point is that these are things that you learn once but keep forever. And, the more you apply your skills, the easier it will be to make a living.

2. Consider Real Estate

Real estate is one of the most sustainable investments anyone can make, if done right! Boatloads of reputable people such as Grant Cardone teach the ins and outs of real estate. He’s helped me get started by letting me invest with him. You can, too.

3. Get Your Priorities Straight

Someone told you to put your eggs in one basket. When investing your time, energy, and effort in something, diversify your eggs. An example of this is my choice to stay in college and make money online at the same time. Set yourself up with multiple sources of income by spreading your eggs. You do this, and you will always have an arm behind your back — considering how risky investing is, it’s not a bad idea. Millionaires, on average, have 7 sources of income. No financial expert will tell you to put your life savings in one stock.

4. Social Media Is a Vacuum; Don’t Get Sucked In

It’s the most popular source of traffic that exists. Why not market there? The nice thing is it allows you to reach a specific group of people based on certain interests they share, which helps you gear your content toward the right people. Anyone who understands how to market using social media is on the way to success. Just about every person who walks the earth has a presence online. But most people are active on many platforms with an easy and reachable contact.

***Fun Fact Since You’re Still Reading***

Facebook estimated 2.7 billion people use Facebook, WhatsApp, Instagram, or Messenger each month. And more than 2.1 billion people use at least one of the Facebook family of services every day on average.

5. Outline Your Friendship Circle

It is said that you are the average of the 5 people you hang around with. Think about that, and then adjust it so that you are surrounding yourself with people who fit your future, not your past.

Disclaimer:

Nothing in this article constitutes legal advice or gives rise to a solicitor/client relationship. Specialist legal advice should be taken in relation to specific circumstances.

The contents of this site are for general information purposes only. Whilst we endeavor to ensure the information on this site is correct, no warranty, express or implied, is given as to its accuracy and we do not accept any liability for error or omission.

We shall not be liable for any damages (including, without limitation, damage for loss of business or loss of profits) arising in this article or any material contained in it, or from any action or decision taken as a result of using this site or any such material.

Opinions expressed here are opinions of the Author. Influencive does not endorse or review brands mentioned; does not and cannot investigate relationships with brands, products, and people mentioned and is up to the Author to disclose. Accounts and articles may be professional fee-based.