In the wake of events that have led to FTX’s file for bankruptcy, many crypto investors have been clamoring for centralized exchanges to be transparent with their holdings. With a history of crypto exchanges going belly up, it’s only natural that a lack of honesty leaves many wondering who is next. In an effort to help soothe worries in these turbulent times, nine exchanges- Binance, Gate.io, KuCoin, Poloniex, Bitget, Huobi, OKX, Deribit, and Bybit- have claimed that they will publish their proof-of-reserves.

No Reservations Here

Changpeng Zhao, CEO of Binance, saw fit to post a tweet recommending that all crypto exchanges perform Merkle tree proof-of-reserves. This was followed days later with a blog post detailing the exchange’s promise of transparency, as well as the wallet addresses of some of their largest holdings. Other exchanges quickly picked up on the trend- KuCoin followed suit with their own blog post of promises and wallet data. Ben Zhou of Bybit tweeted they are working on conducting their Merkle tree proof-of-reserve, and Gate.io promised they will be open sourcing the code used in their proof-of-reserves system.

Though these may be the beginnings of a long overdue standard for some exchanges, others have been quick to point out that they have held themselves to these standards for a while. Kraken posted a statement that they have “long taken the lead when it comes to transparency,” pointing out that they have conducted regular audits and published two proof-of-reserves already in 2022. Bitfinex stated that they began work four years ago on “an in-house, open source library called Antani… to demonstrate exchange-wide proof-of-reserves.”

Merkle-What?

Proof-of-reserves may be a concept that is easy enough to follow. How a “Merkle tree” fits into this, or what it even is… perhaps not so much. A Merkle tree is a data structure used in computer science applications, including cryptocurrencies. In essence, this structure allows blockchain data to be encoded more efficiently by not needing to run an entire block of transaction data through the hash at once. Rather, a transaction block is split into “leaves” that are hashed in pairs that “branch” together until you have a final hash at the top.

The reason this is all important for proof-of-reserves is that centralized exchanges record user’s assets in the ledger of a centralized database. Exchanges can then store the hash value of the assets on a user’s account in one of the “leaves,” which can be easily audited by a third party.

Is it Enough?

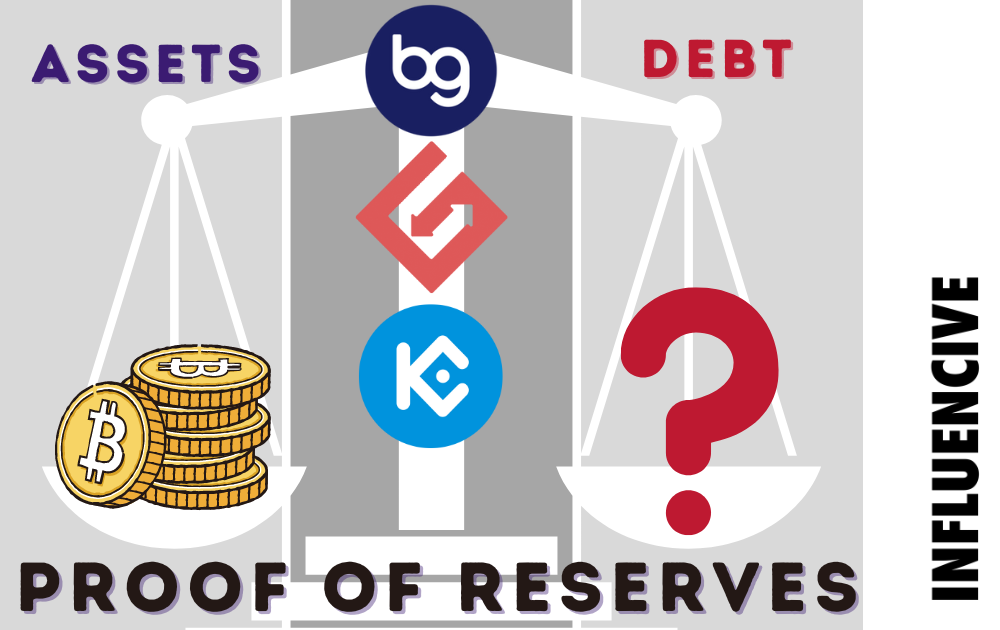

With many private exchanges being veiled in secrecy for so long, any amount of transparency may seem to be a large amount of progress. Many remain skeptical that these proof-of-reserves have any real value, however. Full audits on exchanges such as Binance will take weeks, an eternity in the crypto ecosystem. The most glaring issue with posting proof-of-reserves without any other look into an exchange’s finances is that they have no way of including another crucial dataset- debt. Without knowing an exchange’s liabilities, there is no way for investors to determine how valuable an exchange’s holdings truly are.

Private exchanges will most likely always stay a little more secretive than public ones. How long most of them will remain private remains to be seen- Binance plans to be public in 2024. Time will tell if the fall of FTX will lead to improvements in the relations between crypto investors and these exchanges. Time will also tell if, perhaps, the right move was to keep just a little more in a decentralized wallet.

This is a Contributor Post. Opinions expressed here are opinions of the Contributor. Influencive does not endorse or review brands mentioned; does not and cannot investigate relationships with brands, products, and people mentioned and is up to the Contributor to disclose. Contributors, amongst other accounts and articles may be professional fee-based.